BP 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

BP Annual Report and Accounts 2008

Notes on financial statements

Financial statements

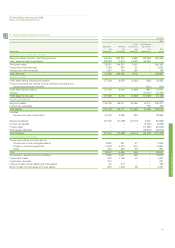

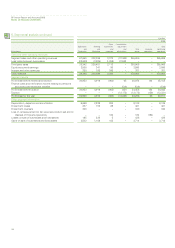

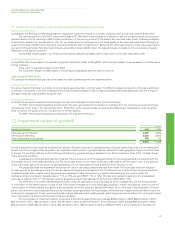

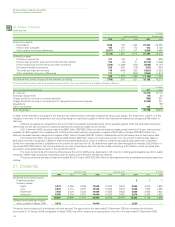

12. Impairment review of goodwill continued

Refining and Marketing

In previous years, Refining and Marketing goodwill has been allocated to the following cash-generating units: Refining, Retail, Lubricants, and Other.

In 2008, the Refining and Retail units were largely integrated into geographically-based Fuels Value Chain units (FVC) and consequently the cash-

generating units to which goodwill is allocated have been redefined. The goodwill previously allocated to the global Refining and Retail units has

been aggregated and reallocated to the FVC units that are expected to benefit from the synergies of the business combinations that gave rise to the

goodwill. As part of this reallocation a small amount of goodwill was also allocated to business units included in ‘Other’. Goodwill is now allocated

to the following cash-generating units: Rhine FVC, US West Coast FVC, Lubricants and Other.

For all cash-generating units, the cash flows for the first three years are derived from the three-year business segment plan. For determining

the value in use for each of the cash-generating units, cash flows for a period of 10 years have been discounted and aggregated with a terminal value.

A key assumption for the FVCs is the Global Indicator Margin (GIM). Each regional GIM is based on a single representative crude with product yields

characteristic of the typical level of upgrading complexity.

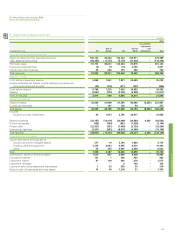

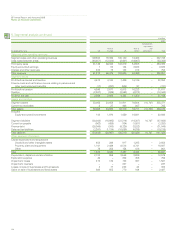

Rhine FVC

Cash flows beyond the three-year period are extrapolated using a 1.2% growth rate.

The key assumptions to which the calculation of value in use for the Rhine FVC unit is most sensitive are refinery gross margins, refinery

production volumes and discount rate. The average value assigned to the refinery gross margin during the plan period is based on a $5.50 per barrel

GIM. The average value assigned to the refinery production volume is 250mmbbl a year over the plan period. These key assumptions reflect past

experience and are consistent with external sources.

The Rhine FVC’s recoverable amount exceeds its carrying amount by $3.6 billion. Based on sensitivity analysis, it is estimated that: (i) if the GIM

changes by $1 per barrel, the Rhine FVC’s value in use changes by $2.1 billion and, if there was an adverse change in the GIM of $1.70 per barrel, the

recoverable amount of the Rhine FVC would equal its carrying amount; (ii) if the volume assumption changes by 13mmbbl a year, the Rhine FVC’s value

in use changes by $1.2 billion and, if there is an adverse change in refinery volumes of 36mmbbl a year, the recoverable amount of the Rhine FVC

would equal its carrying amount; and (iii) a change of 1% in the discount rate would change the Rhine FVC’s value in use by $0.8 billion and, if the

discount rate increases to 17% the value in use of the Rhine FVC would equal its carrying amount.

US West Coast FVC

Cash flows beyond the three-year period are extrapolated using a 2% growth rate.

The key assumptions to which the calculation of value in use for the West Coast FVC unit is most sensitive are refinery gross margins, refinery

production volumes and discount rate. The average value assigned to the refinery gross margin during the plan period is based on a $7.60 per barrel

GIM. The average value assigned to the refinery production volume is 170mmbbl a year over the plan period. These key assumptions reflect past

experience and are consistent with external sources.

The West Coast FVC’s recoverable amount exceeds its carrying amount by $1.6 billion. Based on sensitivity analysis, it is estimated that: (i) if the

GIM changes by $1 per barrel, the West Coast FVC’s value in use changes by $1.5 billion and, if there was an adverse change in the GIM of $1.10 per

barrel, the recoverable amount of the West Coast FVC would equal its carrying amount; (ii) if the volume assumption changes by 8mmbbl a year, the

West Coast FVC’s value in use changes by $1.1 billion and, if there is an adverse change in refinery volumes of 12mmbbl a year, the recoverable

amount of the West Coast FVC would equal its carrying amount; and (iii) a change of 1% in the discount rate would change the West Coast FVC’s value

in use by $0.6 billion and, if the discount rate increases to 14% the value in use of the West Coast FVC would equal its carrying amount.

Lubricants

Cash flows beyond the three-year period are extrapolated using a 3% growth rate (2007 3%).

For the Lubricants unit, the key assumptions to which the calculation of value in use is most sensitive are operating margin, sales volumes and

discount rate. The average values assigned to the operating margin and sales volumes over the plan period are 70 cents per litre (2007 65 cents per

litre) and 3.4 billion litres a year (2007 3.3 billion litres a year) respectively. These key assumptions reflect past experience.

The Lubricants unit’s recoverable amount exceeds its carrying amount by $5.4 billion. Based on sensitivity analysis, it is estimated that: (i) if

there is an adverse change in the operating margin of 14 cents per litre, the recoverable amount of the Lubricants unit would equal its carrying amount;

(ii) if the sales volume assumption changes by 200 million litres a year, the Lubricants unit’s value in use changes by $1.4 billion and, if there is an

adverse change in Lubricants sales volumes of 700 million litres a year, the recoverable amount of the Lubricants unit would equal its carrying amount;

and (iii) a change of 1% in the discount rate would change the Lubricants unit’s value in use by $1.4 billion and, management believes no reasonably

possible change in the discount rate would lead to the Lubricants unit’s value in use being equal to its carrying amount.

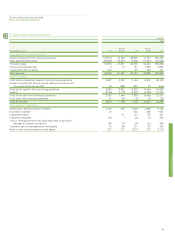

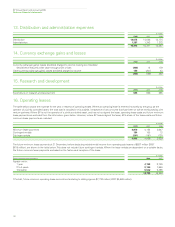

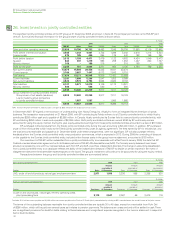

$ million

2008

US West

Rhine FVC Coast FVC Lubricants Other Total

Goodwill 637 1,579 3,043 203 5,462

Excess of recoverable amount over carrying amount 3,603 1,629 5,445 n/a n/a

$ million

2007

Refining Retail Lubricants Other Total

Goodwill 1,515 827 4,175 109 6,626

Excess of recoverable amount over carrying amount 11,443 4,062 5,028 n/a n/a

Comparative narrative information is not generally shown because, due to the reorganization of the Refining and Marketing business in 2008, the

information is not relevant to an understanding of the current year’s financial statements.