BP 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Performance review

In March 2008, the Canadian federal government updated its April 2007

Framework Report with an Action Plan to address climate change and

reduce emissions 20% below 2006 levels by 2020 and by greater than

60% by 2050, through both a sector approach and domestic

development and deployment of new technologies and projects. For the

conventional oil and gas industry, the intensity based targets as included

in the plan of the April 2007 Framework Report remain likely. For the oil

sands industry, more stringent requirements are likely to emerge for

upcoming projects that may include requirements for significant

reductions, including the implementation of large scale carbon capture

and sequestration. Since the conclusion of the recent Canadian and US

Federal elections there has been increased discussion on the possibility

of aligning regulations, including possible inclusion of a North America

wide cap-and-trade system.

Since 1997, BP has been actively involved in the policy debate.

We also ran a global programme that reduced our operational GHG

emissions by 10% between 1998 and 2001. We continue to look at two

principal kinds of GHG emissions: operational emissions, which are

generated from our operations such as refineries, chemicals plants and

production facilities; and product emissions, generated by our customers

when they use the fuels and products that we sell. Since 2001, we have

been focusing on measuring and improving the carbon intensity of our

operations as well as developing sustainable low-carbon technologies

and businesses.

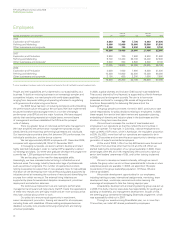

After seven years, we estimate that our operations have delivered

some 7.5 million tonnes (Mte) of GHG reductions. Our 2008 operational

GHG emissions were 61.4Mte of CO2 equivalent on a direct equity

basis, nearly 2.1Mte lower than the reported figure of 63.5Mte in 2007.

The primary reason for the lower reported emissions is a reporting

protocol change for BP Shipping (1.9Mte) to align us more closely with

industry practice.

In 2007, as part of our technology development, two major

BP-backed research institutes came into full operation: the Energy

Biosciences Institute (EBI) in the US, and the Energy Technologies

Institute (ETI) in the UK. The EBI is a strategic partnership between BP,

the University of California, Berkeley, the Lawrence Berkeley National

Laboratory and the University of Illinois, Urbana-Champaign to conduct

research into the production of new and cleaner energy, initially focusing

on advanced biofuels for road transport. The EBI will also pursue

bioscience-based research into the conversion of heavy hydrocarbons to

clean fuels, improved recovery from existing oil and gas reservoirs and

carbon sequestration. In the UK, the ETI has been established as a 50:50

public private partnership, funded equally by member companies,

including BP, and the government. The ETI aims to accelerate the

development, demonstration and eventual commercial deployment of a

focused portfolio of energy technologies, which will increase energy

efficiency, reduce GHG emissions and help achieve energy security

and climate change goals. The ETI has issued its first invitation for

expressions of interest to participate in programmes to develop new

technologies for offshore wind and for marine, tidal and wave energy.

BP established the Carbon Mitigation Initiative in 2000 at Princeton

University in the US to research the fundamental scientific,

environmental, and technological issues that will determine how carbon

is managed in the future and examine the policy impact of different

options. BP’s original 10-year commitment initially funded the programme

at $1.5 million per year and later increased it to more than $2 million per

year. In October 2008, BP committed to a five-year renewal of the

partnership and to support Princeton to at least its current level of

funding for the years 2011 to 2015.

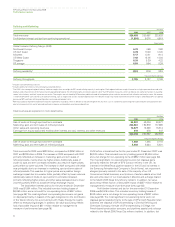

Maritime oil spill regulations

Within the US, the Oil Pollution Act of 1990 (OPA 90) imposes oil spill

prevention and planning requirements liability for tankers and barges

transporting oil and for offshore facilities such as platforms and onshore

terminals. To ensure adequate funding for oil spill response and

compensation, OPA 90 created the Oil Spill Liability Trust Fund that is

financed by a tax on imported and domestic oil. In 2006, the Coast Guard

and Maritime Transportation Act 2006, increased the size of the fund from

the original amount of $1 billion to $2.7 billion. In late 2008, as part of the

Emergency Economic Stabilization Act, further amendments were made

to increase the per-barrel contribution rate of tax and to remove the

provision for cessation of the tax when the fund reached $2.7 billion.

There is now no limit on the size of the fund. The same 2008 legislation

amended the termination date of this tax from 31 December 2014 to

31 December 2017. The 2006 legislation also increased the OPA limitation

amount relating to the liability of double-hulled tankers from $1,200 per

gross tonne to $1,900 per gross tonne. In addition to the spill liabilities

imposed by OPA 90 on the owners and operators of carrying vessels,

some states, including Alaska, Washington, Oregon and California, impose

additional liability on the shippers or owners of oil spilled from such

vessels. The exposure of BP to such liability is mitigated by the vessels’

marine liability insurance, which has a maximum limit of $1 billion for each

accident or occurrence. OPA 90 also provides that all new tank vessels

operating in US waters must have double hulls and existing tank vessels

without double hulls must be phased out by 2015. At the end of 2008, BP

owned four double-hulled tankers built between 2004 and 2006, demise-

chartered to and operated by Alaska Tanker Company, L.L.C. (ATC), which

transports BP Alaskan crude oil from Valdez.

Outside of US territorial waters, the BP-operated fleet of tankers

is subject to international spill response and preparedness regulations

that are typically promulgated through the International Maritime

Organization (IMO) and implemented by the relevant flag state

authorities. The International Convention for the Prevention of Pollution

from Ships (Marpol 73/78) requires vessels to have detailed shipboard

emergency and spill prevention plans. The International Convention on Oil

Pollution, Preparedness, Response and Co-operation requires vessels to

have adequate spill response plans and resources for response anywhere

the vessel travels. These conventions and separate Marine Environmental

Protection Circulars also stipulate the relevant state authorities around

the globe that require engagement in the event of a spill. All these

requirements together are addressed by the vessel owners in Shipboard

Oil Pollution Emergency Plans. BP Shipping’s liabilities for oil pollution

damage under the OPA 90 and outside the US under the 1969/1992

International Convention on Civil Liability for Oil Pollution Damage (CLC)

are covered by marine liability insurance, having a maximum limit of

$1 billion for each accident or occurrence. This insurance cover is

provided by three mutual insurance associations (P&I Clubs): The United

Kingdom Steam Ship Assurance Association (Bermuda) Limited; The

Britannia Steam Ship Insurance Association Limited; and The Standard

Steamship Owners’ Protection and Indemnity Association (Bermuda)

Limited. With effect from 20 February 2006, two new complementary

voluntary oil pollution compensation schemes were introduced by tanker

owners, supported by their P&I Clubs, with the agreement of the

International Oil Pollution Compensation Fund at the IMO. Pursuant to

both these schemes, tanker owners will voluntarily assume a greater

liability for oil pollution compensation in the event of a spill of persistent

oil than is provided for in CLC. The first scheme, the Small Tanker

Owners’ Pollution Indemnification Agreement (STOPIA), provides for a

minimum liability of 20 million Special Drawing Rights (around $30

million) for a ship at or below 29,548 gross tonnes, while the second

scheme, the Tanker Owners’ Pollution Indemnification Agreement

(TOPIA), provides for the tanker owner to take a 50% stake in the 2003

Supplementary Fund, that is, an additional liability of up to 273.5 million

Special Drawing Rights (around $405 million). Both STOPIA and TOPIA

will only apply to tankers whose owners are party to these agreements

and who have entered their ships with P&I Clubs in the International

Group of P&I Clubs, so benefiting from those clubs’ pooling and

reinsurance arrangements. All BP Shipping’s managed and time-

chartered vessels participate in STOPIA and TOPIA.

For information regarding maritime security issues, see Shipping

on page 39.

Performance review

45