BP 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Performance review

Looking ahead, in 2009 the overall economic environment is expected to

be challenging with reduced demand for our products leading to lower

volumes and pressure on margins. The impact is expected to be greatest

in the petrochemicals sector.

Against this background, we intend to continue actively managing

our cost base, simplifying our marketing footprint and developing the market

positions where we have competitive advantage based on brand and

technology strengths. We also intend to improve the efficiency of our back

office, including customer service, accounting services and procurement

systems, by centralizing these activities in a few global centres to remove

duplication and reduce cost. We intend to focus on cash generation through

active management of our working capital and credit exposure.

We intend to limit our capital investment to maintaining and improving our

core positions. To continue the progress we have made in recent years, our

top priority for spending will remain safety and operational integrity. The

other area of focus will be delivering integrated value in our key markets

through investment in terminals and pipeline infrastructure. Our largest

investment is expected to be at the Whiting refinery, where we have

started a major upgrading and modernization programme that will enable

the refinery to operate on Canadian heavy crude oil. We also intend to

complete the planned projects in petrochemicals (see page 36).

Comparative information presented in the table below has been

restated, where appropriate, to reflect the resegmentation, following

transfers of businesses between segments, that was effective from

1 January 2008. See page 16 for further details.

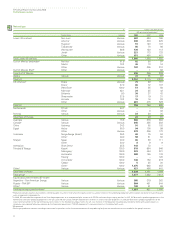

Key statistics

$ million

2008 2007 2006

Total revenuesa 320,458 250,897 232,833

Profit before interest and tax from

continuing operationsb (1,884) 6,076 4,919

Total assets 75,329 95,311 80,738

Capital expenditure and acquisitions 6,634 5,495 3,127

$ per barrel

Global Indicator Refining Marginc 6.50 9.94 8.39

aIncludes sales between businesses.

bIncludes profit after interest and tax of equity-accounted entities.

cThe Global Indicator Refining Margin (GIM) is the average of regional industry indicator margins,

which we weight for BP’s crude refining capacity in each region. Each regional indicator margin is

based on a single representative crude with product yields characteristic of the typical level of

upgrading complexity. The refining margins are industry-specific rather than BP-specific measures,

which we believe are useful to investors in analyzing trends in the industry and their impact on our

results. The margins are calculated by BP based on published crude oil and product prices and take

account of fuel utilization and catalyst costs. No account is taken of BP’s other cash and non-cash

costs of refining, such as wages and salaries and plant depreciation. The indicator margin may not

be representative of the margins achieved by BP in any period because of BP’s particular refining

configurations and crude and product slate.

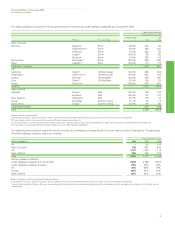

Total revenues are analysed in more detail below.

$ million

2008 2007 2006

Sale of crude oil through spot and

term contracts

Marketing, spot and term sales

of refined products

Other sales and operating revenues

Earnings from equity-accounted

entities (after interest and tax),

interest, and other revenues

54,901

248,561

16,577

419

43,004

194,979

12,238

676

38,577

177,995

15,814

447

320,458 250,897 232,833

thousand barrels per day

Sale of crude oil through spot and

term contracts

Marketing, spot and term sales

of refined products

1,689

5,698

1,885

5,624

2,110

5,801

thousand barrels per day

Sales of refined productsa 2008 2007 2006

Marketing sales

UKb 310 339 356

Rest of Europe 1,256 1,294 1,340

US 1,460 1,533 1,595

Rest of World 685 640 581

Total marketing salesc 3,711 3,806 3,872

Trading/supply salesd 1,987 1,818 1,929

Total refined products 5,698 5,624 5,801

$ million

Proceeds from sale of refined

products 248,561 194,979 177,995

aExcludes sales to other BP businesses, sales of Aromatics & Acetyls products and Olefins &

Derivatives sales through equity-accounted entities.

bUK area includes the UK-based international activities of Refining and Marketing.

cMarketing sales are sales to service stations, end-consumers, bulk buyers and jobbers (i.e. third

parties who own networks of a number of service stations and small resellers).

dTrading/supply sales are sales to large unbranded resellers and other oil companies.

The following table sets out marketing sales by major product group.

thousand barrels per day

Marketing sales by refined product 2008 2007 2006

Aviation fuel 501 490 488

Gasolines 1,500 1,572 1,603

Middle distillates 1,055 1,119 1,170

Fuel oil 460 429 388

Other products 195 196 223

Total marketing sales 3,711 3,806 3,872

Marketing volumes were 3,711mb/d, slightly lower than last year,

reflecting the impacts from the slowing of global economies and reduced

industry demand in the US and Europe.

Fuels value chains

Following our reorganization we have six integrated FVCs. They are

organized regionally, covering the West Coast and Mid-West regions of

the US, the Rhine region, Southern Africa, Australasia (ANZ) and Iberia.

Each of these is a material business, optimizing activities across the

supply chain – from crude delivery to the refineries; manufacture

of high-quality fuels to meet market demand; pipeline and terminal

infrastructure and the marketing and sales to our customers. The Texas

City refinery is operated as a standalone predominantly merchant refining

business that also supports our marketing operations on the east and

gulf coasts.

Refining

The group’s global refining strategy is to own and operate strategically

advantaged refineries that benefit from vertical integration with our

marketing and trading operations, as well as horizontal integration with

other parts of the group’s business. Refining’s focus is to maintain and

improve its competitive position through sustainable, safe, reliable and

efficient operations of the refining system and disciplined investment

for integrity management, to achieve competitively advantaged

configuration and growth.

For BP, the strategic advantage of a refinery relates to its location,

scale and configuration to produce fuels from lower-cost feedstocks in

line with the demand of the region. Strategic investments in our

refineries are focused on securing the safety and reliability of our assets

while improving our competitive position. In addition, we continue to

invest to develop the capability to produce the cleaner fuels that meet

the requirements of our customers and their communities.

32