BP 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Performance review

Refining and Marketing

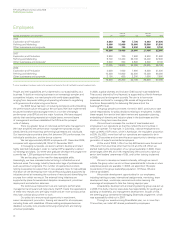

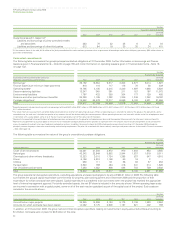

$ million

2008 2007 2006

Total revenuesa 320,458 250,897 232,833

Profit before interest and tax from continuing operationsb (1,884) 6,076 4,919

$ per barrel

Global Indicator Refining Margin (GIM)c

Northwest Europe 6.72 4.99 3.92

US Gulf Coast 6.78 13.48 12.00

Midwest 5.17 12.81 9.14

US West Coast 7.42 15.05 14.84

Singapore 6.30 5.29 4.22

BP average 6.50 9.94 8.39

%

Refining availabilityd 88.8 82.9 82.5

thousand barrels per day

Refinery throughputs 2,155 2,127 2,198

aIncludes sales between businesses.

bIncludes profit after interest and tax of equity-accounted entities.

cThe GIM is the average of regional industry indicator margins that we weight for BP’s crude refining capacity in each region. Each regional indicator margin is based on a single representative crude with

product yields characteristic of the typical level of upgrading complexity. The refining margins are industry-specific rather than BP-specific measures, which we believe are useful to investors in analyzing

trends in the industry and their impact on our results. The margins are calculated by BP based on published crude oil and product prices and take account of fuel utilization and catalyst costs. No account

is taken of BP’s other cash and non-cash costs of refining, such as wages and salaries and plant depreciation. The indicator margin may not be representative of the margins achieved by BP in any period

because of BP’s particular refining configurations and crude and product slate.

dRefining availability represents Solomon Associates’ operational availability, which is defined as the percentage of the year that a unit is available for processing after subtracting the annualized time lost

due to turnaround activity and all planned mechanical, process and regulatory maintenance downtime.

Total revenues are explained in more detail below.

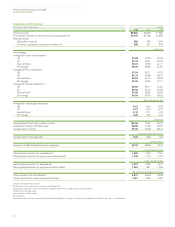

$ million

2008 2007 2006

Sale of crude oil through spot and term contracts 54,901 43,004 38,577

Marketing, spot and term sales of refined products 248,561 194,979 177,995

Other sales and operating revenues 16,577 12,238 15,814

Earnings from equity-accounted entities (after interest and tax), interest, and other revenues 419 676 447

320,458 250,897 232,833

thousand barrels per day

Sale of crude oil through spot and term contracts 1,689 1,885 2,110

Marketing, spot and term sales of refined products 5,698 5,624 5,801

Total revenues for 2008 were $320 billion, compared with $251 billion in

2007 and $233 billion in 2006. The increase in 2008 compared with 2007

primarily reflected an increase in marketing, spot and term sales of

refined products, mainly driven by higher prices. Additionally, sales of

crude oil, spot and term contracts increased, as a result of higher prices,

partly offset by lower volumes. The increase in 2007 compared with 2006

was principally due to an increase in marketing, spot and term sales of

refined products. This was due to higher prices and a positive foreign

exchange impact due to a weaker dollar, partially offset by lower volumes.

Additionally, sales of crude oil, spot and term contracts increased,

primarily reflecting higher prices, and other sales decreased due to lower

volumes partially offset by a positive foreign exchange impact.

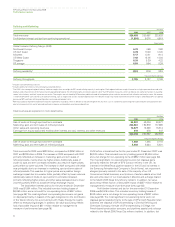

The loss before interest and tax for the year ended 31 December

2008 was $1,884 million. This included inventory holding losses of

$6,060 million and a net credit for non-operating items of $347 million

(see page 56). The most significant non-operating items were net gains

on disposal (primarily in respect of the gain recognized on the contribution

of the Toledo refinery into a joint venture with Husky Energy Inc.) partly

offset by restructuring charges. In addition, fair value accounting effects

had a favourable impact of $511 million relative to management’s

measure of performance (see page 56).

Profit before interest and tax for the year ended 31 December 2007 was

$6,076 million. This included inventory holding gains of $3,455 million

and a net charge for non-operating items of $952 million (see page 56).

The most significant non-operating items were net disposal gains

(primarily related to the sale of BP’s Coryton refinery in the UK, its

interest in the West Texas pipeline system in the US and its interest in

the Samsung Petrochemical Company in South Korea), net impairment

charges (primarily related to the sale of the majority of our US

Convenience Retail business, a write-down of certain assets at our Hull

site and write-down of our retail assets in Mexico) and a charge related

to the March 2005 Texas City refinery incident. In addition, fair value

accounting effects had an unfavourable impact of $357 million relative to

management’s measure of performance (see page 56).

Profit before interest and tax for the year ended 31 December

2006 was $4,919 million. This included inventory holding losses of

$242 million and a net charge for non-operating items of $387 million

(see page 56). The most significant non-operating items were net

disposal gains (related primarily to the sale of BP’s Czech Republic retail

business, the disposal of BP’s shareholding in Zhenhai Refining and

Chemicals Company, the sale of BP’s shareholding in Eiffage, the

French-based construction company, and pipelines assets) and a charge

related to the March 2005 Texas City refinery incident. In addition, fair

54