Avnet 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

PROFITABLE GROWTH

The world’s

leading technology

suppliers and more

than 100,000

customers put

their trust in us.

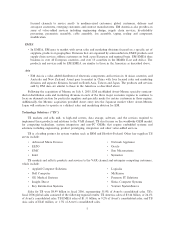

$550

500

450

400

350

300

250

200

150

100

50

0‘02 ‘03 ‘04 ‘05 ‘06

Operating Income (2)

(in millions)

$524

Sales by Operating Group

e

l

e

c

t

r

o

n

i

c

s

m

a

r

k

e

t

i

n

g

t

e

c

h

n

o

l

o

g

y

s

o

l

u

t

i

o

n

s

65%

35%

4.0%

3.0

2.0

1.0

0‘02 ‘03 ‘04 ‘05 ‘06

Operating Income Margin (2)

3.7%

(percentage)

We started FY‘06 with a significant opportunity, the acquisition of Memec Group Holdings, Ltd. With sales of

$2.3 billion and operations in 33 countries, Memec was the largest specialist semiconductor distributor focused

on design services. By providing engineering expertise to customers, they built a unique business that was also

attractive to semiconductor suppliers wanting their proprietary products designed into customers’ goods.

Despite the workload associated with the integration, our team stayed focused externally on our customers’

and suppliers’ needs. As a result, our trading partners remained loyal. Our revenue grew and profits soared,

while we substantially accelerated working capital velocity and return on total capital.

It’s one thing to grow revenue by acquiring a company, but it is also important to grow organically. In FY‘06,

we added more than $900 million in revenue on top of Memec’s $2.3 billion, an increase of 8 percent.(3)

Five years ago, we turned our attention to profitable growth with return on capital and economic profits, rather

than accounting profits, as our primary measures of success. At 11 percent ROCE, we exceeded our weighted

average cost of capital and created shareholder value as we exited FY‘06, evidence that we are delivering more

value and getting paid fairly for it. Our objective is to outpace the markets we serve on the top line and grow

economic profits substantially faster than sales.

With our superior technical expertise and supply chain solutions, we are taking advantage of synergistic

opportunities to sell more components, services and solutions to customers throughout the design-to-

manufacturing process. In FY‘06, our electronic components business, Avnet Electronics Marketing:

• Grew revenue 48 percent to $9.26 billion(1)

• Grew operating income 80 percent to $419 million(2)

• Rapidly increased ROWC every quarter (2)

For computer products, our growth standouts were storage, software and services. We are now targeting

vertical markets with value-added scalable services. We are expanding our line card to embrace emerging

technologies and complementary new suppliers. In FY‘06, Avnet Technology Solutions:

• Substantially exceeded our 12.5 percent ROCE hurdle rate each quarter

• Achieved double-digit revenue growth in its largest business unit

• Expanded operating income margin 25 basis points(1)

Avnet opens the International IC

China Conference and Exhibition.