Avnet 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S LETTER

1

Avnet serves

a $1 trillion

market growing

approximately

7 percent per

year. Distribution’s

share of that

is more than

$235 billion.

Growth

opportunities

abound.

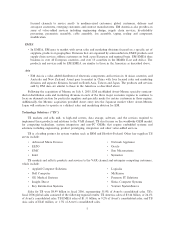

$1.50

1.25

1.00

.75

.50

.25

0

-.25

-.50

-.75

$10

9

8

7

6

5

4

3

2

1

0‘02 ‘03 ‘04 ‘05 ‘06

GAAP Earnings

(Loss) Per Diluted Share

$1.39

$2.00

1.75

1.50

1.25

1.00

.75

.50

.25

0

-.25

-.50

-.75 ‘02 ‘03 ‘04 ‘05 ‘06

Non-GAAP Earnings (2)

(Loss) Per Diluted Share

$1.96

‘02 ‘03 ‘04 ‘05 ‘06

Sales

(in billions)

Electronics

Marketing

Technology

Solutions

$9.26

$4.99

Dear Avnet Shareholder: What a year! Record sales on the top line. Record net income on the

bottom line. Record efficiency and productivity metrics for profitability and asset velocity. Near record

earnings per share. Other important financial metrics — return on capital employed (ROCE), return on

working capital (ROWC), operating income margin and dollars — reached levels not seen since before

the technology bubble burst more than five years ago. Alone, each is noteworthy. Together, they tell

the story of a company whose focus on profitable growth, operational excellence and the development

of its people is having a profoundly positive impact on our long-term business model.(2)

• Revenue — Up 29 percent to $14.25 billion (1)

• Operating income — Up 63 percent to $524 million (2)

• Operating income margin — Up 78 basis points to 3.7 percent (2)

• Net income — Up 71 percent to $288 million (2)

• Earnings per share (EPS) — Up 41 percent to $1.96 (2)

• ROWC & ROCE — As we exited the year, we delivered 27 percent ROWC for the fourth quarter, up

749 basis points, and 11 percent ROCE, up 251 basis points from last year’s fourth quarter (2)

More than 326,000 devices are programmed at

Avnet Logistics & Solutions Centers every day.

Avnet’s innovative culture and

entrepreneurial spirit assure

customers and suppliers they

have chosen the right partner.

The Avnet brand flourishes at trade shows and

industry events around the world.