Atari 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Atari annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL FINANCIAL REPORT – REGISTRATION DOCUMENT

4

GENERAL INFORMATION

CORPORATE PROFILE

Atari (“the Company” or “the Group”) is listed on the Euronext Paris market, compartment C (ISIN code: FR0010478248,

ticker: ATA).

Atari group is a global creator, producer and publisher of interactive entertainment for key platforms, including online

(casual, social, Massively Multiplayer Online Game – “MMO” games), PC, consoles from Microsoft, Nintendo and Sony,

and advanced smart phones (i.e. IPhone, Android and RIM devices).

Atari benefits from its global brand and an extensive catalogue of popular games based on classic owned game

franchises (Asteroids, Centipede, Missile Command, Lunar Lander), original owned franchises (Test Drive, Backyard

Sports, Deer Hunter, Champions) and third party franchises (Ghostbusters, Rollercoaster Tycoon, Dungeons and

Dragons, Star Trek).

After several years of transformation and restructuring, fiscal year 2009-2010 marked the beginning of the Company’s

migration from retail to an online business oriented company. Significant actions were taken in fiscal year 2009-2010

towards strengthening Atari’s online platform, including notably:

• The reorganization of the Group structure with appropriate management, including i) Cryptic and Eden studios,

ii) the newly formed Platform and shared-service group division, created to further enhance and develop the

Atari platform and improve customer service and online distribution, and iii) publishing operations in the US;

• The success of its issue through the free allocation of warrants to Atari’s shareholders entitling them to

subscribe for new shares and/or ORANE, resulting in the raising of €43 million dedicated to the Company’s

videogame publishing plan and allowing a strengthening of the shareholder equity;

• The launch of the first two MMO games of the Group: Champions Online and Star Trek Online;

• The continuation of cost control;

• The finalization, in fiscal year 2009/2010 of the divestiture of the European/Asian distribution operations to

accelerate the shift towards online game content and in fiscal year 2010/2011 of the debt settlement (for more

details, see Notes 1.3 and 22 to the consolidated financial statements);

• Atari’s strategic plan is designed to create a leading online-focused gaming company, with emphasis on

profitable online social and casual games, particularly from owned franchises, MMO games and also lower risk

retail games based on owned products and third party agreements.

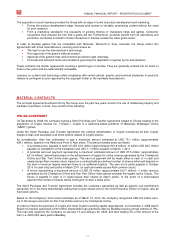

FINANCIAL HIGHLIGHTS

For the year ended March 31, 2010, the Company’s total revenue decreased by 15% to €115.7 million.

The following table presents the Group’s main financial figures prepared in accordance with IFRS 5, where applicable

(1)

:

(€ millions) March 31, 2010 March 31, 2009

March 31, 2008

Revenue 115.7

136.4

90.3

Current operating loss (22.0)

(68.9)

(53.4)

Operating loss (24.7)

(123.2)

(52.5)

Loss from continuing operations

(3)

(26.9)

(131.9)

(65.6)

Profit (loss) from discontinued operations 3.7

(90.8)

3.1

Net loss

(3)

(23.2)

(222.7)

(51.1)

Total assets 91.7

209.9

303.8

Shareholders’ equity

(3)

1.8

(13.3)

153.4

Net cash/net debt (9.2)

(56.4)

48.7

Cash and cash equivalents 10.3

5.9

83.4

Number of employees

(2)

380

387

288

(1) The 2007-2008, 2008-2009 and 2009-2010 financial data are based on IFRS and are restated where applicable in

accordance with IFRS 5. The net income (loss) from the Namco Bandai Partners business, which has been sold on July 7,

2009, is reported on the line “Profit (loss) from discontinued operations” as from April 1, 2007. Group revenue and current

operating income for fiscal year 2007-2008, 2008-2009 and 2009-2010 exclude the Namco Bandai Partners business.

(2) Number of employees for continued operations. The total number of employees for continued and discontinued operations

amounted to 380 as of March 31, 2010, 679 as of 2009 and 555 as of March 31, 2008.

(3) Prior fiscal year financial statements have been restated for the correction of income tax expense (€4.2 million)