Atari 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Atari annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL FINANCIAL REPORT – REGISTRATION DOCUMENT

21

General and administrative expenses

General and administrative expenses decreased approximately 39% from €25.0 million in the prior year to €15.3 million.

These savings are primarily attributable to the continuing cost containment programs implemented across the Company

and the restructuring of our European operations.

Share-based incentive payment expense

Share-based payments were -€1.6 million versus €6.4 million in the prior year, an improvement of €8.0 million. This

improvement is primarily due to the departure of the former management team and their related share-based expenses.

This decrease was partially offset by the expenses associated with the new management team.

Restructuring expenses

Restructuring costs for the year ended March 31, 2010 amounted to €2.6 million versus €13.9 million in the previous

year. This decrease was primarily due to the prior year costs related to the Atari Transformation plan announced in May

2008 and the publishing and corporate restructuring announced in the last quarter of fiscal year 2008-2009. The current

year costs are associated with various leased facility and employee related restructures.

Impairment of goodwill

The poor performance of the publishing unit resulted in the recognition of a goodwill impairment for the Retail

Development/Publishing cash-generating unit of €40.3 million for the year ended March 31, 2009. Impairment tests

performed on March 31, 2010 did not result in any write-downs.

Operating income (loss)

There was an operating loss at the consolidated level of €24.7 million, compared with €123.2 million the previous year,

an improvement of €98.5 million. This improvement reflects the combined impact of from loss on ordinary operations of

€46.9 million as discussed above, incremental restructuring charges of €11.3 million and the prior year goodwill

impairment of €40.3 million.

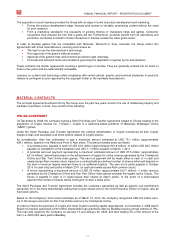

OTHER INCOME STATEMENT ITEMS

(in € millions)

Operating income (loss)

(24,7)

-124,4%

(123,2)

-58,1%

98,5

-80,0%

Cost of debt (4,4) (7,7) 3,3 -42,9%

Other financial income (expense) (0,4) (4,1) 3,7 -90,2%

Income tax 2,6 3,1 -0,5 N/A

Profit (loss) from continuing operations

(26,9)

-23,2%

(131,9)

-146,1%

105,0

-79,6%

Profit (loss) from discontinued operations 3,7 (90,8) 94,5 N/A

Consolidated net income (loss)

(23,2)

-20,1%

(222,7)

-246,6%

199,5

-89,6%

Minority interests 3,8 0,8 3,0 375,0%

Net income (loss) attributable to equity holders

of the parent (19,4) -16,8% (221,9) -245,7% 202,5 -91,3%

March 31, 2010 March 31, 2009

restated* Change

*Prior fiscal year financial statements have been restated for the correction of income tax expense (€4.2 million)

Cost of debt

Cost of debt was €4.4 million, down €3.3 million or 43% as compared to the prior year. This decrease was due to lower

average debt balances in the current year as compared to the prior year. The Company used the proceeds from the

January 2010 equity raise to reduce debt levels.

Other financial income (expenses)

Other financial income (expense) decreased by €3.7 million primarily due to fluctuations in the exchange rates during the

prior fiscal year.