Atari 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Atari annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL FINANCIAL REPORT – REGISTRATION DOCUMENT

20

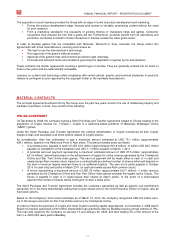

2. ANALYSIS OF THE CONSOLIDATED FINANCIAL STATEMENTS

2.1 SUMMARY ACTUAL CONSOLIDATED INCOME STATEMENT

(€ millions)

Revenue

115.7

136.4

-20.7

-15.2%

Cost of goods sold (58.1) -50.2% (87.9) -64.4% 29.8 -33.9%

Gross margin

57.6

49.8%

48.5

35.6%

9.1

18.8%

Research and development expenses (48.9) -42.3% (67.0) -49.1% 18.1 -27.0%

Marketing and selling expenses (17.0) -14.7% (19.0) -13.9% 2.0 -10.5%

General and administrative expenses (15.3) -13.2% (25.0) -18.3% 9.7 -38.8%

Share-based payment expense 1.6 1.4% (6.4) -4.7% 8.0 -125.0%

Current operating income (loss)

(22.0)

-19.0%

(68.9)

-50.5%

46.9

-68.1%

Restructuring costs (2.6) (13.9) 11.3

Impairment of goodwill 0.0 (40.3) -40.3

Other operating income (expenses) (0.1) (0.1) 0.1

Operating income (loss)

(24.7)

-21.3%

(123.2)

-90.3%

-70.7

134.7%

March 31, 2010

March 31, 2009

Change

Revenue

Revenue was €115.7 million for the year ended March 31, 2010, compared with €136.4 million for the previous fiscal

year, a decrease of 15.2%.

The decrease was primarily due to lower publishing revenue in FY 2009/2010, partially offset by increased online and

licensing revenue. For FY2009/2010, Atari focused on selling fewer but more profitable games. Sales were driven by

Atari’s major releases over the period (Ghostbusters: The Video Game, Backyard Football 2010, Champions Online and

Star Trek Online).

€ millions

Online 12.5 10.8% 2.6 1.9%

Retail & Other 103.2 89.2% 133.8 98.1%

Total

115.7

100.0%

136.4

100.0%

March 31, 2010 March 31, 2009

Online revenue, comprised primarily of subscription and digital distribution revenue, was €12.5 million – an increase of

€9.9 million over the prior year. This increase was primarily due to subscription and digital distribution revenue from the

launch of the Star Trek Online and Champions Online MMO games. Online revenues were 11% of total net sales as

compared to 2% in the prior fiscal year.

Retail and other revenues, comprised primarily of sales to retail stores, decreased by €30.6 million to €103.2 million, due

to a lower number of titles and price pressure in a weak economic environment. Retail and other revenues were 89% of

total net revenue as compared to 98% in the prior fiscal year.

Gross margin

Gross margin for the year ended March 31, 2010 was 49.8% as a percentage of revenue, compared with 35.6% for the

previous year. This increase was due to better performing retail titles and a larger percentage of higher margin online

revenue in the current year.

Research and development expenses

Research and development expenses decreased €18.1 million to €48.9 million, as compared with €67.0 million for the

previous period. This improvement was primarily due to write-downs of €31.0 million in the prior year mostly related to

the reorganization of the publishing business. The current year reflects write-downs of €16.5 million primarily from the

MMO business. Amortization of development costs were lower in the current fiscal year versus the prior year as a result

of large budget, externally developed games in the prior year.

Marketing and selling expenses

Marketing and selling expenses were €17.0 million, compared with €19.0 million for the previous period. This decrease

was primarily due to prior year spend to support major publishing releases such as Alone in the Dark, The Chronicles of

Riddick, Race Pro and others. As a percentage of net revenue, external marketing and selling costs were down

approximately 1.3 ppt. due to improved cost control measures. This decrease was partially offset by higher internal

marketing costs due to the re-staffing of the marketing department.