Assurant 2005 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2005 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

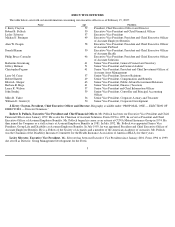

ASSURANT, INC.

One Chase Manhattan Plaza

41

st

Floor

New York, NY 10005

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 2, 2005

This Proxy Statement is furnished to stockholders of Assurant, Inc. (which we sometimes refer to in this proxy statement as “Assurant” or

the “Company”) in connection with the solicitation by the Board of Directors of Assurant of proxies to be voted at the 2005 Annual Meeting of

Stockholders (the “Annual Meeting”) to be held at the Bull Run Conference Center, 52 William Street, 2

nd

Floor, New York, NY on June 2,

2005, at 9:30 a.m. or at any adjournment or postponement thereof. We expect to mail the proxy solicitation materials for the Annual Meeting

on or about April 27, 2005.

The principal solicitation of proxies for the Annual Meeting is being made by mail. Officers, directors and employees of Assurant, none of

whom will receive additional compensation therefor, may also solicit proxies by telephone or other personal or electronic contact. We have

retained Mellon Investor Services LLC to assist in the solicitation of proxies for an estimated fee of $6,000 plus reimbursement of expenses.

We will bear the cost of the solicitation of proxies, including postage, printing and handling, and will reimburse brokerage firms and other

record holders of shares beneficially owned by others for their reasonable expenses incurred in forwarding solicitation material to beneficial

owners of shares.

A stockholder may revoke his or her proxy at any time before it is voted by delivering a later dated, signed proxy or other written notice of

revocation to the Corporate Secretary of Assurant. Any record holder of shares present at the Annual Meeting may also withdraw his or her

proxy and vote in person on each matter brought before the Annual Meeting. All shares represented by properly signed and returned proxies in

the accompanying form, unless revoked, will be voted in accordance with the instructions given thereon. If no instructions are given, the shares

will be voted in favor of Proposals One and Two described in this Proxy Statement.

Only stockholders of record at the close of business on the April 12, 2005, the record date for the Annual Meeting, will be entitled to notice

of and to vote at the Annual Meeting or at any postponement or adjournment thereof. As of the close of business on that date,

138,813,659 shares of our Common Stock, par value $0.01 per share (the “Common Stock”), were outstanding. Common Stock holders will

each be entitled to one vote per share of Common Stock held by them. In addition, on the record date, we had 24,160 shares of Preferred Stock,

par value $1.00 per share (the “Preferred Stock”), outstanding and entitled to vote on all matters to be voted upon at the Annual Meeting. All

shares of Preferred Stock are held of record by Robert S. DeLue and Rita DeLue, as trustees of The Robert S. and Rita DeLue 1995 Revocable

Family Trust. The holders of Preferred Stock are entitled to one vote per share of Preferred Stock held by them and vote with the holders of

Common Stock as a single class, and not as a separate class.

Votes cast in person or by proxy at the Annual Meeting will be tabulated by the inspector of elections appointed for the meeting. Pursuant

to Assurant’s Bylaws and the Delaware General Corporation Law (the “DGCL”), the presence of the holders of shares representing a majority

of the outstanding shares of Common Stock entitled to vote at the Annual Meeting, whether in person or by proxy, is necessary to constitute a

quorum for the transaction of business at the Annual Meeting. Under the DGCL, abstentions and “broker non-votes” will be treated as present

for purposes of determining the presence of a quorum. Broker non-votes are proxies from brokers or nominees as to which such persons have

not received instructions from the beneficial owners or other persons entitled to vote with respect to a matter on which the brokers or nominees

do not have the discretionary power to vote.

The election of each of the director nominees under Proposal One requires that each director be elected by the holders of a plurality of the

voting power present in person or represented by proxy and entitled to vote at the Annual Meeting. The approval of Proposal Two requires the

affirmative vote of the holders of a majority

1