Assurant 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

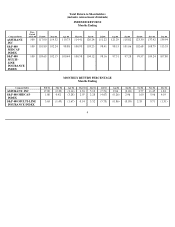

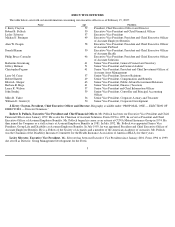

COMPENSATION OF DIRECTORS AND NAMED EXECUTIVE OFFICERS

The following table sets forth the cash and other compensation paid by Assurant and its subsidiaries to the named executive officers of

Assurant for all services in all capacities during the years indicated.

Summary Compensation Table

11

Long

-

Term Compensation

Awards

Payouts

Annual Compensation

Securities

Name and

Other Annual

Restricted Stock

Underlying

LTIP

All Other

Principal Position

Year

Salary

Bonus

Compensation(1)

Awards(2)

Options(3)

Payouts(4)

Compensation(5)

($)

($)

($)

($)

(#)

($)

($)

J. Kerry Clayton

2004

840,000

1,444,800

3,059

583,230

—

5,053,676

172,368

President and Chief

2003

811,200

1,622,400

—

—

30,000

—

865,864

Executive Officer

2002

780,000

1,560,000

—

—

30,000

—

54,600

Robert B. Pollock

2004

672,000

1,155,840

5,428

279,960

—

3,619,251

124,271

Executive Vice President

2003

649,000

1,103,300

1,761

—

15,000

69,244

468,515

and Chief Financial Officer

2002

624,000

1,067,368

—

—

15,000

—

43,680

Lucinda Landreth

2004

415,000

1,030,860

2,503

28,809

—

119,360

84,574

President and Chief

2003

400,000

877,200

3,000

—

1,000

282,910

66,076

Investment Officer(6)

2002

212,307

330,804

—

1,000

—

8,000

Philip Bruce Camacho

2004

544,000

656,880

25,128

75,550

—

669,899

60,351

Executive Vice President;

2003

525,000

318,150

23,320

—

4,000

—

129,865

President and Chief Executive

Officer, Assurant Solutions

2002

478,400

278,907

14,966

—

4,000

220,000

33,488

Lesley Silvester

2004

448,000

654,976

19

186,630

—

1,529,874

70,727

Executive Vice

2003

432,600

562,380

3,000

—

10,000

—

240,942

President

2002

416,000

540,800

—

—

10,000

—

29,120

(1) The named executive officers received the following perquisites and other personal benefits: (i) $3,000 for a one-time, personal financial

counseling session, including tax preparation, estate planning, and an in-depth explanation of the Company’s executive compensation

program as it applies to each executive (paid in 2004 for Mr. Clayton and Mr. Pollock, and in 2003 for Ms. Silvester, Mr. Camacho and

Ms. Landreth); (ii) $2,500 for additional financial counseling sessions paid to Ms. Landreth in 2004; (iii) a gross-up payment for

Medicare taxes paid on compensatory stock dividends of $0.07 per share paid by the Company in 2004 with respect to unvested restricted

stock, in the following amounts: Mr. Clayton, $59; Mr. Pollock, $28; Ms. Landreth, $3; Mr. Camacho, $8 and Ms. Silvester, $19,

(iv) reimbursements of membership fees of $10,103 and reimbursements of conference expenses of $12,165 paid to Mr. Camacho in

2004, $13,726 for reimbursements of conference expenses paid to Mr. Camacho in 2003 and reimbursements of conference expenses of

$9,810 paid to Mr. Camacho in 2002; (v) reimbursements of conferences expenses of $1,501 paid to Mr. Pollock in 2004 and $1,037 in

2003; (vi) gross-up payments to Mr. Pollock of $899 for taxes paid on reimbursement of conference expenses in 2004 and $724 in 2003;

and (vii) gross-up payments to Mr. Camacho of $2,852 for taxes paid on reimbursement of conference expenses in 2004, $6,594 in 2003

and $5,156 in 2002.

(2) Awards of restricted shares to the named executive officers during fiscal year 2004 were made under the Assurant, Inc. 2004 Long-Term

Incentive Plan. The value of the awards that is shown in the table is based upon the closing market price of the Common Stock on the

grant dates. Grantees have the right to vote, and dividends are payable to the grantees with respect to all awards of restricted shares

reported in this column. All shares of restricted stock underlying the market value shown in the table are scheduled to vest in equal annual

installments over the three years following the date of grant, subject to accelerated vesting pursuant to the terms of the 2004 Long-Term

Incentive Plan. The aggregate holdings underlying the aggregate market value of restricted stock held as of December 31, 2004, by the

individuals listed in this table are: Mr. Clayton, 19,091 shares; Mr. Pollock, 9,164 shares; Ms. Landreth, 943 shares; Ms. Silvester,

6,109 shares; and Mr. Camacho, 2,473 shares.