Assurant 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

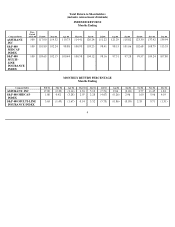

Long-Term Incentive Plan Awards

The following table presents information concerning long-term incentive plan awards to the named executive officers under the

Appreciation Incentive Rights Plan during the fiscal year ended December 31, 2004:

12

(3) The option grants shown in this table represent options granted for the particular year pursuant to the Fortis, Inc. Stock Option Plan to

acquire shares of Fortis Inc.’s Series D Preferred Stock, the value of which is related to the market value of shares of Fortis N.V. and

Fortis SA/ NV, and the Euro to U.S. dollar conversion rate. On October 15, 2003, our Board of Directors authorized the discontinuance of

this plan effective September 22, 2003, and all stock options outstanding thereunder were cancelled in exchange for a payment of the fair

value of such options, as determined by an independent third party.

(4) Amounts shown in this column represent amounts that were paid or payable in the given year under the Appreciation Incentive Rights

Plan.

(5) Amounts shown in this column for the fiscal year ended December 31, 2004, include the following amounts: (i) for Mr. Clayton, $14,350

for Company contributions under the Assurant 401(k) Plan and $158,018 for Company contributions under the 401(k) portion of the

Assurant Executive Pension and 401(k) Plan; (ii) for Mr. Pollock, $14,350 for Company contributions under the Assurant 401(k) Plan

and $109,921 for Company contributions under the 401(k) portion of the Assurant Executive Pension and 401(k) Plan; (iii) for

Ms. Landreth, $14,350 for Company contributions under the Assurant 401(k) Plan and $70,224.01 for Company contributions under the

401(k) portion of the Assurant Executive Pension and 401(k) Plan; (iv) for Mr. Camacho, $14,350 for Company contributions under the

Assurant 401(k) Plan and $46,000.51 for Company contributions under the 401(k) portion of the Assurant Executive Pension and 401(k)

Plan; and (v) for Ms. Silvester, $14,350 for Company contributions under the Assurant 401(k) Plan and $56,376.61 for Company

contributions under the 401(k) portion of the Assurant Executive Pension and 401(k) Plan.

(6) Ms. Landreth voluntarily terminated her employment on December 31, 2004, and on such date forfeited the 943 shares of restricted stock

that were granted to her in 2004.

Estimated Future

Payouts Under

Performance or

Non-Stock

Number of Shares,

Other Period Until

Price-Based

Units or Other

Maturation or

Plans

Name

Rights (#)

Payout

Target(1)($)

J. Kerry Clayton

124,136

(2)

3 Years

840,000

Robert B. Pollock

89,378

(2)

3 Years

604,800

Lucinda Landreth(3)

—

—

—

Philip Bruce Camacho

21,625

(4)

3 Years

353,600

Lesley Silvester

49,655

(2)

3 Years

336,000

(1) As described more fully under “— Assurant Appreciation Incentive Rights Plan,” during 2004, an eligible employee of Assurant, Inc.

received 75% of his or her award in Assurant, Inc. incentive rights and 25% of his or her award in operating business segment incentive

rights. Conversely, an eligible employee of an operating business segment of Assurant received 25% of his or her award in Assurant, Inc.

incentive rights and 75% of his or her award in operating business segment incentive rights. Each incentive right represents the right to

the appreciation in value of an incentive right over the vesting period of the award, based on a valuation provided by an independent,

qualified appraiser.

(2) Represents the total number of incentive rights awarded. Rights are distributed between Assurant, Inc. (75%) and each of the four

operating business segments (25%). The Assurant, Inc. incentive rights were replaced with stock appreciation rights on shares of Assurant

common stock following the Company’s initial public offering, as more fully described under “— Assurant Appreciation Incentive

Rights Plan.

”