Assurant 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

employment for good reason, then (1) the participant will become 100% vested in his or her SERP benefit; (2) the participant will be credited

with 36 additional months of service for purposes of computing his or her target benefit; and (3) the actuarial reduction for commencement of

the SERP benefit prior to age 60 will be calculated as though the participant was 36 months older than his or her actual age.

The SERP provides that if the payments to a participant or beneficiary will be made over a period of more than one year and if at the time

payments commence the Company is not subject to pending proceedings as a debtor under the U.S. Bankruptcy Code, then Fortis Insurance

N.V. will guarantee the payment of SERP benefits to such participant or beneficiary. The SERP further provides that if Fortis Insurance N.V.

ceases to be the beneficial owner of the Company, then such guarantee will be limited to the actuarially equivalent value of the participant’s

SERP benefit immediately following such cessation of beneficial ownership.

Effective January 1, 1994, our Board of Directors adopted the Executive Pension and 401(k) Plan, which is a non-qualified, unfunded

deferred compensation plan for certain key executives of the Company and its subsidiaries. The pension portion of this plan (referred to herein

as the Executive Pension Plan) is intended to restore to participants amounts that they are restricted from receiving under the Assurant Pension

Plan, described below, due to section 401(a)(17) of the U.S. tax code, which generally limits the compensation that may be taken into account

under a tax-qualified pension plan to no more than $205,000 annually in 2004 (subject to cost of living adjustments).

A participant becomes vested in the benefits under the Executive Pension Plan after three years of vesting service, if he or she has elected to

participate in the pension equity portion of the Assurant Pension Plan, and after five years of vesting service if he or she has elected to

participate in the pension formula that predated the pension equity formula under the Assurant Pension Plan. The benefits under the Executive

Pension Plan are payable in a single lump sum.

Assurant Pension Plan

Since 1983, we have maintained the Assurant Pension Plan, which is a tax-qualified, defined benefit pension plan subject to regulation

under ERISA. Eligible employees generally may participate in the Plan after completing one year of service with the Company. The Assurant

Pension Plan provides for multiple benefit formulas for different groups of participants. Benefits under the plan are payable at termination of

employment. A participant’s benefit may be paid in a lump sum or in various annuity forms.

Employment and Change in Control Agreements

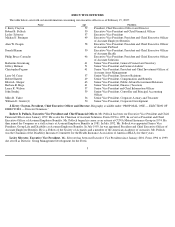

We have entered into change in control severance agreements with Mr. Clayton, our other named executive officers and other officers and

key employees. The severance agreements generally provide that if a change in control (as defined) occurs with respect to the business segment

for which an employee works, then a two-year trigger period begins. If the employee’s employment is terminated by us without cause or if the

employee resigns for good reason (each as defined) during such two-year period, the employee is entitled to certain cash severance payments

and continuation of medical and other welfare benefits for a period of 18 months following the termination of employment at the rate charged

active employees.

The amount of cash severance benefits payable to an employee is equal to a multiple (ranging from one to three depending on the

agreement, and equal to three for Mr. Clayton and our other named executive officers) times the sum of the employee’s annual base salary and

target annual bonus. The cash severance is payable within 30 days of the date of the employee’s termination, subject to the “key employee”

limitations under the American Jobs Creation Act of 2004. In addition, if a change in control has occurred and the employee’s employment has

been terminated by us without cause or if the employee has resigned for good reason within one year prior to the change in control, then the

employee is entitled to the cash severance benefits described above, to be paid in a lump sum in cash within 30 days after the change in control

has occurred, and continuation of medical and other welfare benefits for a period of 18 months at the rate charged active employees, except that

we shall reimburse the employee for the cost of obtaining such welfare benefits

15

Executive Pension and 401(k) Plan