Assurant 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

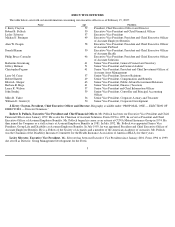

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table and paragraphs provide, with respect to each person or entity known by Assurant to be the beneficial owner of more

than 5% of Assurant’s outstanding Common Stock as of February 15, 2005, (a) the number of shares of Common Stock so owned (based upon

the most recently reported number of shares outstanding as of the date the entity filed a Schedule 13G with the Securities and Exchange

Commission), and (b) the percentage of all outstanding shares represented by such ownership as of February 15, 2005 (based on an outstanding

share amount of 139,932,659 as of that date).

9

Shares of Common

Stock Owned

Percentage of

Name of Beneficial Owner

Beneficially

Class

Fortis Insurance N.V.(1)

22,999,130

16.44

%

FMR Corp.(2)

10,196,160

7.29

%

JPMorgan Chase & Co.(3)

9,937,235

7.10

%

T. Rowe Price Associates, Inc.(4)

7,059,800

5.05

%

(1) Fortis Insurance N.V., Archimedeslaan 6, 3584 BA, Utrecht, The Netherlands, filed a Schedule 13G on February 11, 2005, representing

its share ownership as of December 31, 2004, with respect to the beneficial ownership of 50,199,130 shares, representing 35.9% of our

Common Stock. Fortis Insurance N.V.’s holdings decreased to 22,999,130 shares after the completion of a secondary offering of their

shares on January 20, 2005. This represented 16.44% of our Common Stock, as of February 15, 2005.

(2) FMR Corp., 82 Devonshire Street, Boston, Massachusetts 02109, filed a Schedule 13G on February 14, 2005, with respect to the

beneficial ownership of 10,196,160 shares. This represented 7.29% of our Common Stock as of February 15, 2005.

(3) JPMorgan Chase & Co., 270 Park Avenue, New York, New York 10017, filed a Schedule 13G on February 11, 2005, with respect the

beneficial ownership of 9,937,235 shares. This represented 7.10% of our Common Stock as of February 15, 2005. JPMorgan Chase &

Co. has indicated that it filed this Schedule 13G on behalf of the following wholly-

owned subsidiaries: J.P. Morgan Chase Bank, National

Association, J.P. Morgan Investment Management, Inc., J.P. Morgan Trust Company, National Association, J.P. Morgan Fleming Asset

Management (UK) Limited, Bank One Trust Co., N.A., One Group Mutual Funds, and Banc One Investment Advisors Corporation.

During 2004, several entities we believe to be affiliated with JP Morgan Chase & Co. provided various financial services to Assurant,

including services such as acting as a dealer under our commercial paper facility and as a lender under our revolving credit facility and

providing cash management, underwriting, custody and broker-dealer services. We have also provided various insurance products to

entities we believe to be affiliated with JP Morgan Chase & Co. In addition, since 1994, Assurant has leased office space at One Chase

Manhattan Plaza, 41

st

Floor, New York, NY 10005 from The Chase Manhattan Bank (National Association).

(4) T. Rowe Price Associates, Inc., 100 E. Pratt Street, Baltimore, Maryland 21202, filed a Schedule 13G on February 8, 2005, with respect

to the beneficial ownership of 7,059,800 shares. This represented 5.05% of our Common Stock as of February 15, 2005. These securities

are owned by various individual and institutional investors for which T. Rowe Price Associates, Inc. (“Price Associates”) serves as

investment adviser with power to direct investments and /or sole power to vote the securities. For purposes of the reporting requirements

of the Securities and Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, in its

Schedule 13G, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities.