Airtran 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

63

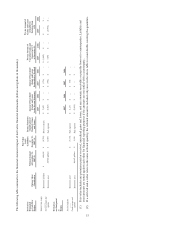

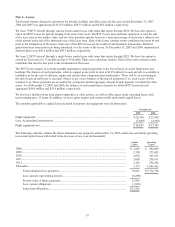

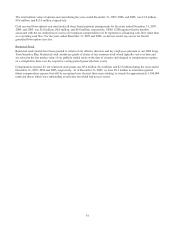

Note 10 – Other Comprehensive Income

Other comprehensive income is composed of changes in the fair value of certain of our derivative financial instruments and

the funded status of our postemployment obligations. The components of “Accumulated other comprehensive income (loss)”,

are as follows (in thousands):

Unrealized

gain (loss) on

derivative

instruments

Postemploym

ent

obligations

Accumulated ot

her

comprehensive

income (loss)

Balance at Januar

y

1, 2005....................................................................... $ — $ — $ —

Changes in fair valu

e

................................................................................ — — —

Reclassification to earnings ...................................................................... — — —

Balance at December 31, 2005.................................................................. — — —

Changes in fair value, net of income taxes ................................................ 84 — 84

Reclassification to earnings ...................................................................... — — —

Adjustment to initially adopt FAS 158, net of income taxes ...................... — (5,336) (5,336)

Reclassification to earnings ...................................................................... — — —

Balance at December 31, 2006.................................................................. 84 (5,336) (5,252)

Changes in fair value, net of income taxes ................................................ 15,721 — 15,721

Reclassification to earnings, net of income taxes....................................... (14,688) 1,012 (13,676)

Change in actuarial gains and losses , net of income taxes......................... — 4,557 4,557

Balance at December 31, 2007.................................................................. $ 1,117 $ 233 $ 1,350

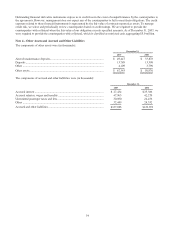

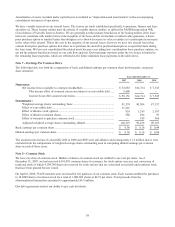

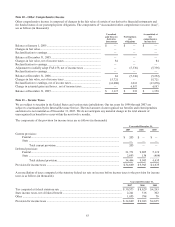

Note 11 – Income Taxes

We are subject to taxation in the United States and various state jurisdictions. Our tax years for 1996 through 2007 are

subject to examination by the Internal Revenue Service. The total amount of unrecognized tax benefits and related penalties

and interest is not material as of December 31, 2007. We do not anticipate any material change in the total amount of

unrecognized tax benefits to occur within the next twelve months.

The components of the provision for income taxes are as follows (in thousands):

Year ended Decembe

r

31

,

2007 2006 2005

Current provision:

Federal..................................................................................................................... $ 205 $ — $ —

Stat

e

........................................................................................................................ — — —

Total current provision .................................................................................... 205 — —

Deferred provision:

Federal..................................................................................................................... 31,771 9,805 5,119

Stat

e

........................................................................................................................ 2,693 138 (484

)

Total deferred provision .................................................................................. 34,464 9,943 4,635

Provision for income taxes ................................................................................................ $ 34,669 $ 9,943 $ 4,635

A reconciliation of taxes computed at the statutory federal tax rate on income before income taxes to the provision for income

taxes is as follows (in thousands):

Year ended Decembe

r

31

,

2007 2006 2005

Tax computed at federal statutory rat

e

.................................................................................

.

$ 30,573 $ 8,629 $ 4,263

State income taxes, net of federal benefit .............................................................................

.

2,241 516 302

Other ..................................................................................................................................

.

1,855 798 70

Provision for income taxes ..................................................................................................

.

$ 34,669 $ 9,943 $ 4,635

63

(484)