Airtran 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

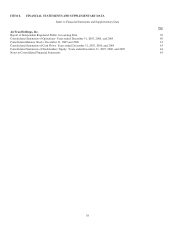

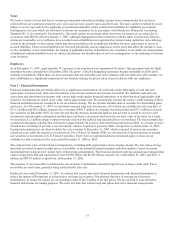

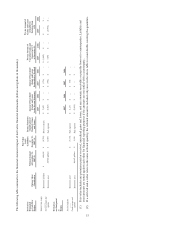

44

AirTran Holdings, Inc.

Consolidated Statements of Stockholders’ Equity

(In thousands)

Common Stock

Additional

Paid-in

Capital

Unearned

Compensation

Accumulated

Other

Comprehensive

Income (Loss)

Accumulated

Earnings

(Deficit)

Total

Stockholders’

Equity

Shares Amount

Balance at January 1, 2005 . 86,617 $ 87 $361,063 $ (4,624) $ — $ (26,858 ) $ 329,668

Net income..............................

.

— — — — — 7,545 7,545

Total comprehensive

income ...............

.

7,545

Issuance of common stock

for exercise of options ....

.

1,783 2 9,775 — — — 9,777

Issuance of common stock

under stock purchase

plan...................................

.

145 — 1,320 — — — 1,320

Unearned compensation on

common stock issues ......

.

246 — 2,917 (2,917) — — —

Tax benefit related to

exercise of nonqualified

stock options and

restricted stock ................

.

— — 1,552 — — — 1,552

Amortization of unearned

compensation...................

.

— — — 3,513 — — 3,513

Balance at December 31, 2005..........

.

88,791 89 376,627 (4,028) — (19,313 ) 353,375

Net income..............................

.

— — — — — 14,714 14,714

Unrealized gain on derivative

instruments, net of

deferred taxes ..................

.

— — — — 84 — 84

Total comprehensive

income ...............

.

14,798

Adjustment to initially apply

SFAS 158, net of income

taxes of $3.1 million .......

.

— — — — (5,336 ) — (5,336 )

Issuance of common stock

for exercise of options ....

.

951 1 5,952 — — — 5,953

Stock-based compensation ....

.

305 — 4,443 — — — 4,443

Adjustment upon adoption of

SFAS 123(R) ...................

.

— — (4,028) 4,028 — — —

Issuance of common stock

for detachable stock

warrants ...........................

.

1,000 1 4,509 — — — 4,510

Issuance of common stock

under employee stock

purchase plan ...................

.

113 — 1,540 — — — 1,540

Balance at December 31, 2006..........

.

91,160 91 389,043 — (5,252 ) (4,599 ) 379,283

Net income..............................

.

— — — — — 52,683 52,683

Unrealized gain on derivative

instruments, net of

income taxes of $0.6

million ..............................

.

— — — — 1,033 — 1,033

Actuarial gain on

postemployment

obligations, net of

income taxes of $2.7

million ..............................

.

— — — — 4,557 — 4,557

Reclassification of

postemployment expense

to earnings, net of

income taxes of $0.6

million ..............................

.

— — — — 1,012 — 1,012

Total comprehensive

income ...............

.

59,285

Issuance of common stock

for exercise of options ....

.

198 — 1,022 — — — 1,022

Stock-based compensation...................

.

374 1 5,403 — — — 5,404

Issuance of common stock

under employee stock

purchase plan ...................

.

154 — 1,356 — — — 1,356

Balance at December 31, 2007..........

.

91,886 $ 92 $ 396,824 $ — $ 1,350 $ 48,084 $ 446,350

See accompanying notes to Consolidated Financial Statements.