Airtran 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

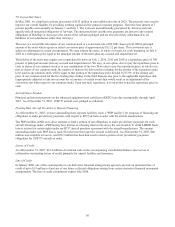

Advertising and Promotion Costs

Advertising costs are charged to expense in the period the costs are incurred. Advertising expense was approximately $35.7 million,

$34.3 million and $35.0 million for the years ended December 31, 2007, 2006 and 2005, respectively.

From time to time we enter into barter transactions whereby we acquire goods or services in exchange for future air travel to be

provided by us. We recognize operating expense based on the estimated fair value of travel to be provided by us. During 2005, we

entered into a barter transaction in which we exchanged flight credits in our frequent flyer program for promotional consideration. The

transaction was originally recorded at the estimated fair value of the credits exchanged resulting in $4.6 million of advertising expense

in 2005. During 2006, we recorded additional expense of $4.1 million related to this promotion due to changes in the estimated

volume of travel exchanged. The revenue relating to the flight credits was recognized as passenger revenue as the credits were utilized

or expired. During 2007, 2006, and 2005, $2.4 million, $5.0 million, and $0.4 million, respectively, related to this program was

recognized as passenger revenue.

Revenue Recognition

Passenger revenue is recognized when transportation is provided. Ticket sales for transportation which has not yet been provided are

recorded as air traffic liability. Air traffic liability represents tickets sold for future travel dates. The balance of the air traffic liability

fluctuates throughout the year based on seasonal travel patterns and fare sale activity. Passenger revenue accounting is inherently

complex and the measurement of the air traffic liability is subject to some uncertainty. A nonrefundable ticket expires at the date of

scheduled travel unless the customer exchanges the ticket in advance of such date for a credit to be used by the customer as a form of

payment. We recognize as revenue the value of a non-refundable ticket at the date of scheduled travel unless the customer exchanges

his or her ticket for a credit. A percent of credits expire unused. We recognize as revenue over time the value of credits that we expect

to go unused in proportion to the credits that are used. We estimate the amount of credits that we expect to go unused based on

historical experience. Estimating the amount of credits that will go unused involves some level of subjectivity and judgment. Changes

in our estimate of the amount of unused credits would have an effect on our revenues.

We are required to collect certain taxes and fees on our passenger tickets. These taxes and fees include U.S. federal transportation

taxes, federal security charges, airport passenger facility charges and foreign arrival and departure taxes. These taxes and fees are legal

assessments on the customer. We have a legal obligation to act as a collection agent. Because we do not retain these taxes and fees, we

do not include such amounts in passenger revenue. We record a liability when the amounts are collected and relieve the liability when

payments are made to the applicable government agency.

Frequent Flyer Program

We accrue a liability for the estimated incremental cost of providing free travel for awards earned under our A+ Rewards Program

based on awards we expect to be redeemed on us or the contractual rate of expected redemption on other carriers. Incremental cost

includes the cost of fuel, catering, and miscellaneous direct costs, but does not include any costs for aircraft ownership, maintenance,

labor or overhead allocation. We adjust this liability based on points earned and redeemed, changes in the estimated incremental costs,

and changes in the A+ Rewards Program.

We also sell points in our A+ Rewards Program to third parties, such as credit card companies, internet service providers and car

rental agencies. Revenue from the sale of points is deferred and recognized as passenger revenue when transportation is expected to be

provided, based on estimates of its fair value. The remaining portion, which is the excess of the total sales proceeds over the estimated

fair value of the transportation to be provided, is recognized in other revenue at the time of sale. A change to the time period over

which the points are used (currently one to two years), the actual redemption activity, or our estimate of the amount or fair value of

expected transportation could have a significant impact on our revenue in the year of change as well as future years.

Derivative Financial Instruments

Statement of Financial Accounting Standards No. 133 (SFAS 133), Accounting for Derivative Instruments and Hedging Activities,

requires companies to recognize all of its derivative instruments as either assets or liabilities in the statement of financial position at

fair value. The accounting for changes in the fair value (i.e., unrealized gains or losses) of a derivative instrument depends on whether

it has been designated and qualifies as part of a hedging relationship and further, on the type of hedging relationship. For those

derivative instruments that are designated and qualify as hedging instruments, a company must designate the hedging instrument,

based upon the exposure being hedged, as a fair value hedge, cash flow hedge or a hedge of a net investment in a foreign operation.