Airtran 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Our liquidity could be adversely impacted in the event one or more of our credit card processors were to impose or increase

existing holdbacks on payments due to us from credit card transactions.

We currently have agreements with organizations that process credit card transactions arising from purchases of air travel tickets by

our customers utilizing American Express, Discover and MasterCard/VISA. Credit card processors have financial risk associated with

tickets purchased for travel because, although the processor generally forwards the cash related to the purchase to us soon after the

purchase is completed, the air travel generally occurs after that time, and the processor would have liability if we do not ultimately

provide the air travel. Each of our agreements with the organizations that process American Express, Discover, and MasterCard/Visa

transactions allows, under specified conditions, the credit card processor to retain cash that such processor otherwise would deliver to

us, i.e., a “holdback”. Generally, in all of our agreements, the holdbacks can be imposed at the discretion of the processor upon the

occurrence of specified events, including material adverse changes in our financial condition, or if the processor reasonably believes

we will be unable to perform our obligations. As of December 31, 2007, we were in compliance with the terms of our credit card

agreements and had holdbacks with only two processors, which were in amounts that were not material.

A majority of our revenues relate to credit card transactions processed by the MasterCard/Visa processor. Our agreement with the

MasterCard/Visa credit card processor contains covenants that permit the processor to holdback cash remittances to us, if the

processor determines that there has been a material adverse occurrence or certain other events occur. The amount which the processor

may be entitled to withhold varies over time and is up to the estimated liability for future air travel purchased with Visa and

MasterCard cards ($145.6 million as of December 31, 2007). As of December 31, 2007, we were in compliance with the agreement

and no remittances had been withheld.

In the event material holdbacks are imposed, our liquidity in the form of unrestricted cash and short-term investment assets would be

reduced by the amount of the holdbacks. We believe we have, and will continue to have, alternatives to address any requirement for

holdbacks by such processors, including seeking to obtain letters of credit in lieu of accepting a holdback or providing a cash deposit.

The agreement with our MasterCard/Visa processor expires December 31, 2008. Our other credit card processing agreements

generally have no fixed term but are terminable without cause after 30 days notice and immediately upon the occurrence of various

specified adverse events. The inability to enter into credit card processing agreements would have a material adverse effect on our

business. We believe we will be able to continue to renew our existing credit card processing agreements or will be able to enter into

new credit card processing agreements with other processors, although we can not assure you that we will always have these options

in the future should we seek to exercise them.

Our business is, and will continue to be, dependent on the availability and price of aircraft fuel.

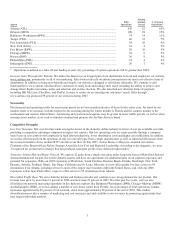

Aircraft fuel is a significant expenditure and, as a percentage of our operating expenses, accounted for 37.0 percent in 2007 and 36.5

percent, and 32.4 percent in 2006 and 2005, respectively. Due to the effect of economic events on the price and availability of oil, the

future availability and cost of aircraft fuel cannot be predicted with any degree of certainty. Although we are currently able to obtain

adequate supplies of aircraft fuel, it is impossible to predict the future availability or price of aircraft fuel. Political disruptions or wars

involving oil-producing countries, changes in government policy concerning the production, transportation or marketing of aircraft

fuel, changes in aircraft fuel production capacity, environmental concerns and other unpredictable events may result in fuel supply

shortages and additional fuel price increases in the future. For 2008, if jet fuel increased $1 per barrel, our fuel expense, before the

impact of hedging arrangements, would increase approximately $10.0 million based on current and projected operations.

Our operations are, and will continue to be, largely dependent upon the availability of fuel in the Gulf Coast area.

Our operations are largely concentrated in the Southeast United States with Atlanta being the highest volume fueling point in our

system. In addition, over 79 percent of our fuel contracts are based on prices of jet fuel produced in the Gulf Coast area. Any

disruption to the oil production or refinery capacity in the Gulf Coast, as a result of weather or any other disaster could, among other

potential effects, have a material adverse effect on our financial condition and results of operations, not only in East Coast routes but

across the network due to disruptions in supply of jet fuel, dramatic escalations in the costs of jet fuel, and/or the failure of fuel

providers to perform under our fuel arrangements.