Airtran 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

60

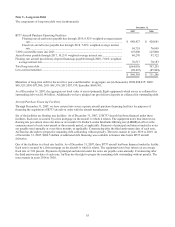

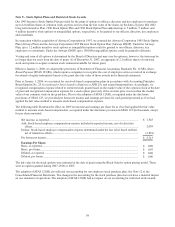

Stock Options

SFAS 123(R) is effective for all stock options granted on or after January 1, 2006. For those stock options that were granted

prior to January 1, 2006, but for which the vesting period is not complete, we used the “modified prospective method” of

accounting permitted under SFAS 123(R). Under this method, stock option awards granted prior to January 1, 2006, but for

which the vesting period is not complete, must be accounted for on a prospective basis with the related cost being recognized

in the financial statements beginning with the first quarter of 2006 using the grant date fair values previously calculated for

our pro forma disclosures. We recognize the related compensation costs not previously reflected in the pro forma disclosures

over the remaining vesting period.

During 2005, we accelerated the vesting for certain unvested stock options awarded that had an exercise price greater than the

market price on the date of the acceleration. The purpose of accelerating the vesting of these options was to avoid

compensation expense in 2006 associated with the unvested options upon adoption of SFAS 123(R).

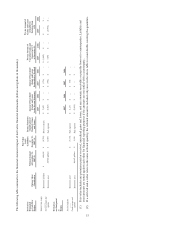

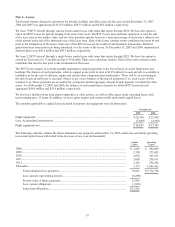

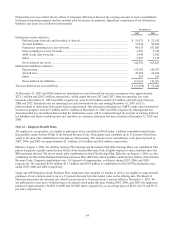

A summary of stock option activity under the aforementioned plans are as follows:

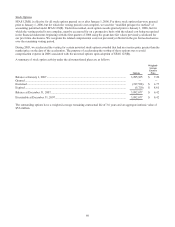

Options

Weighted-

Average

Exercise

Price

Balance at Januar

y

1, 2007......................................................................................................... 3,295,925 $ 7.20

Granted...................................................................................................................................... — —

Exercised ................................................................................................................................... (197,528) $ 4.77

Expired ...................................................................................................................................... (5,720) $ 8.61

Balance at December 31, 2007.................................................................................................... 3,092,677 $ 6.42

Exercisable at December 31, 2007.............................................................................................. 3,092,677 $ 6.42

The outstanding options have a weighted-average remaining contractual life of 3.6 years and an aggregate intrinsic value of

$5.6 million.