Airtran 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

2006 Compared to 2005

Summary

We reported operating income of $40.9 million, net income of $14.7 million and diluted earnings per common share of $0.16 for the

year ended December 31, 2006. For 2005 we reported operating income of $22.6 million, net income of $7.5 million, and diluted

earnings per common share of $0.08.

Operating Revenues

Our operating revenues for year ended December 31, 2006 increased $442.4 million (30.5 percent), primarily due to a 30.0 percent

increase in passenger revenues. The increase in passenger revenues was largely due to a 22.4 percent increase in passenger traffic as

measured by RPMs, and an increase in our average yield per RPM of 6.1 percent to 13.12 cents. The increase in yield resulted

primarily from a 7.8 percent increase in our average fare to $90.51. This increase in yield, when combined with our 0.7 percentage

point decrease in passenger load factor, resulted in a 5.1 percent increase in passenger unit revenues as measured by RASM to 9.55

cents.

During the year ended December 31, 2006, we took delivery of two B717 aircraft and 20 B737 aircraft. As a result, our capacity, as

measured by ASMs, increased 23.7 percent. The combination of our 23.7 percent increase in capacity and 22.4 percent increase in

traffic resulted in a 0.7 percentage point decrease in passenger load factor to 72.8 percent.

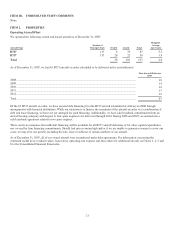

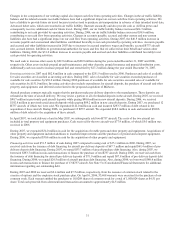

Operating Expenses

Our operating expenses for the year ended December 31, 2006 increased $424.2 million (29.7 percent) or 5.0 percent on a cost per

ASM basis. Our financial results were significantly affected by changes in the price of fuel.

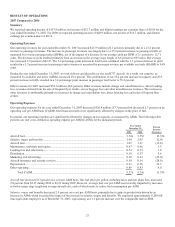

In general, our operating expenses are significantly affected by changes in our capacity, as measured by ASMs. The following table

presents our unit costs, defined as operating expense per ASM, for the indicated periods:

Yea

r

ended

December 31, Percent

Increase

(Decrease)

2006 2005

Aircraft fuel ....................................................................................................................................

.

3.55¢ 3.01¢ 17.9%

Salaries, wages and benefits ............................................................................................................

.

2.05 2.14 (4.2)

Aircraft rent....................................................................................................................................

.

1.21 1.25 (3.2)

Maintenance, materials and repairs..................................................................................................

.

0.66 0.55 20.0

Landing fees and other rents............................................................................................................

.

0.53 0.53 —

Distribution.....................................................................................................................................

.

0.37 0.44 (15.9)

Marketing and advertising...............................................................................................................

.

0.24 0.24 —

Aircraft insurance and security services...........................................................................................

.

0.14 0.15 (6.7)

Depreciation ...................................................................................................................................

.

0.16 0.13 23.1

Other operating...............................................................................................................................

.

0.83 0.84 (1.2)

Total CASM..........................................................................................................................

.

9.74¢ 9.28¢ 5.0%

Aircraft fuel increased 17.9 percent on a cost per ASM basis, primarily due to escalating fuel prices. Our fuel price per gallon,

including all fees and taxes, increased 20.0 percent from $1.81 for the year ended December 31, 2005 to $2.17 for the year ended

December 31, 2006.

Salaries, wages and benefits decreased 4.2 percent on a cost per ASM basis, primarily due to gains in productivity driven by the

increased number of aircraft. We employed approximately 7,400 full-time equivalent employees as of December 31, 2006,

representing a 10.6 percent increase over the comparable date in 2005.

Maintenance, materials and repairs increased 20.0 percent on a cost per ASM basis. On a cost per block hour basis, maintenance

materials and repairs expense increased 21.1 percent to $322 per block hour primarily due to the expiration of warranties on the B717

aircraft and an increase in B717 engine maintenance contract rates. As the original manufacturer warranties expire on our B717 and

B737 aircraft, the maintenance, repair and overhaul of aircraft engines and a significant number of aircraft systems become covered by

maintenance agreements with FAA-approved maintenance, repair, and overhaul providers.