Airtran 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

AirTran Holdings, Inc.

Notes to Consolidated Financial Statements

December 31, 2007

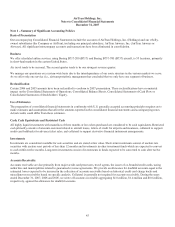

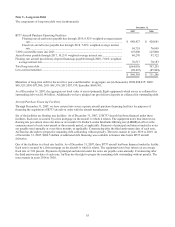

Note 1 – Summary of Significant Accounting Policies

Basis of Presentation

Our accompanying Consolidated Financial Statements include the accounts of AirTran Holdings, Inc. (Holdings) and our wholly-

owned subsidiaries (the Company or AirTran), including our principal subsidiary, AirTran Airways, Inc. (AirTran Airways or

Airways). All significant intercompany accounts and transactions have been eliminated in consolidation.

Business

We offer scheduled airline services, using Boeing B717-200 (B717) and Boeing B737-700 (B737) aircraft, to 55 locations, primarily

in short-haul markets in the eastern United States.

Air travel tends to be seasonal. The second quarter tends to be our strongest revenue quarter.

We manage our operations on a system-wide basis due to the interdependence of our route structure in the various markets we serve.

As we offer only one service (i.e., air transportation), management has concluded that we only have one segment of business.

Reclassification

Certain 2006 and 2005 amounts have been reclassified to conform to 2007 presentation. These reclassifications have no material

impact on the Consolidated Statements of Operations, Consolidated Balance Sheets, Consolidated Statements of Cash Flow or

Consolidated Statements of Stockholders’ Equity.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires us to

make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes.

Actual results could differ from those estimates.

Cash, Cash Equivalents and Restricted Cash

All highly liquid investments with maturities of three months or less when purchased are considered to be cash equivalents. Restricted

cash primarily consists of amounts escrowed related to aircraft leases, letters of credit for airports and insurance, collateral to support

credit card holdbacks for advance ticket sales, and collateral to support derivative financial instrument arrangements.

Investments

Investments are considered available for sale securities and are stated at fair value. Short-term investments consist of auction rate

securities with auction reset periods of less than 12 months and investments in other investment funds which are expected to convert

to cash within twelve months. Long-term investments consist of investments in funds expected to be converted to cash after twelve

months.

Accounts Receivable

Accounts receivable are due primarily from major credit card processors, travel agents, the issuer of co-branded credit cards, taxing

authorities and municipalities related to guaranteed revenue agreements. We provide an allowance for doubtful accounts equal to the

estimated losses expected to be incurred in the collection of accounts receivable based on historical credit card charge backs and

miscellaneous receivables based on specific analysis. Collateral is generally not required for accounts receivable. During the years

ended December 31, 2007, 2006 and 2005, we wrote off accounts receivable aggregating $1.0 million, $1.4 million and $0.6 million,

respectively, against the allowance for doubtful accounts.