Airtran 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

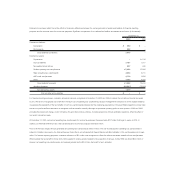

We are authorized to issue up to 4 million shares of common stock under this plan. During 2000, 1999 and 1998 the employees purchased a total of 61,626,

51,318 and 23,023 shares, respectively, at an average price of $4.30, $3.94 and $5.65 per share, respectively, which represented a 5 percent discount from

the market price on the offering dates.

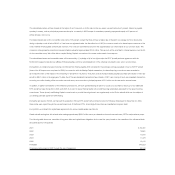

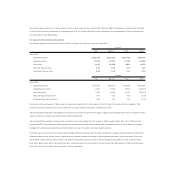

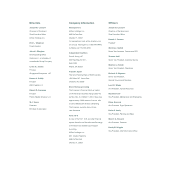

13. Quarterly Financial Data (Unaudited)

Summarized quarterly financial data for 2000 and 1999 is as follows (in thousands, except per share data):

Quarter

First Second Third Fourth

Fiscal 2000

Operating revenues $132,408 $160,769 $161,459 $169,458

Operating income 11,838 31,622 17,103 20,588

Net income 2,902 22,588 8,891 13,055

Basic earnings per share 0.04 0.34 0.14 0.20

Diluted earnings per share 0.04 0.33 0.13 0.19

Quarter

First Second Third Fourth

Fiscal 1999

Operating revenues $119,873 $140,015 $143,483 $ 120,097

Operating income (loss) 9,001 21,455 29,570 (132,014)

Net income (loss) 3,054 14,959 23,167 (140,574)

Basic earnings (loss) per share 0.05 0.23 0.36 (2.15)

Diluted earnings (loss) per share 0.05 0.22 0.34 (2.15)

The results of the fourth quarter of 1999 include an impairment charge of $147.7 million related to the DC-9 fleet. The results of the third quarter of 1999

include net proceeds of $19.6 million from the settlement of a lawsuit against a third-party maintenance provider.

Year-end adjustments resulted in decreasing income before income taxes during the fourth quarter of 2000 by approximately $1.6 million, the majority of which

relates to revisions of expenses recorded in earlier quarters during 2000.

Year-end adjustments resulted in increasing the loss before income taxes during the fourth quarter of 1999 by approximately $5.3 million. Of this amount,

approximately $3.2 million relates to revised revenue amounts recorded in earlier quarters during 1999, and approximately $2.1 million relates to changes in

management’s estimates and assumptions primarily related to accruals for vacation and group health insurance.

During the year, we provide for income taxes using anticipated effective annual tax rates. The rates are based on expected operating results and permanent

differences between book and tax income. Adjustments are made each quarter for changes in the anticipated rates used in previous quarters. If the actual

annual effective rates had been used in each of the quarters of 2000 and 1999, net income for the first through fourth quarters of 2000 would have been

$3.0 million, $23.6 million, $9.2 million and $11.6 million, respectively, and net income (loss) for the first through the fourth quarters of 1999 would have been

$3.3 million, $15.2 million, $22.8 million and ($140.7 million), respectively.