Airtran 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A letter from the Chairman

AirTran Airways’ record financial performance in 2000 was remarkable. What is most exciting is that the growth the Company experienced this past year

is the result of a plan that we believe will yield long-term, sustainable growth well into the future. So while our accomplishments in 2000 are in themselves

tremendously exciting, they’re only the beginning.

Even with skyrocketing fuel prices and tight labor markets, AirTran Airways met incredible consumer air travel demand, built up its network, increased

market share at the world’s busiest airport and ended the year with its eighth consecutive profitable quarter (excluding litigation gains and impairment

charges). I’m pleased to have the opportunity to share with you the details of our success in 2000.

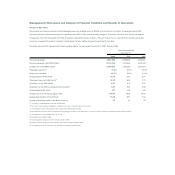

AirTran Airways achieved record net earnings of $47.4 million, up 63 percent from the previous year’s $29.1 million (excluding litigation gains and impairment

charges). This result was obtained on record operating revenues of $624.1 million, up 23.9 percent from $503.8 million the previous year. Your Company

ended the year with $103.8 million in cash, a 36 percent increase from $76.2 million a year ago. Unit revenue, or revenue per available seat mile (RASM),

increased 16 percent to 10.3 cents. We proudly add this to the long list of new Company records in 2000.

As one might expect, our metrics for traffic, capacity and load factor increased dramatically. Load factor increased to 70.2 percent, up 6.7 points from

1999. We flew 4.1 billion revenue passenger miles (RPM) in 2000, compared to 3.5 billion revenue passenger miles in 1999, an 18.5 percent increase in traffic.

More than 7.5 million revenue passengers flew with us in 2000, up from 6.5 million in 1999. This increase in traffic far outpaced our 7.2 percent increase in

capacity which was 5.6 billion available seat miles (ASM). The airline runs in the top of the industry in terms of percentage of completed flights and exceeded

Company goals for completion factor, the measure of flights operated versus flights scheduled.

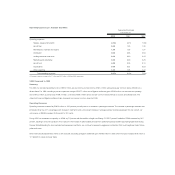

I am extremely proud of our ability to recapitalize the Company, which lays the foundation for continued growth. In November 2000, we entered into

a $220 million financing commitment with the Boeing Corporation which will enable us to refinance the $150 million of AirTran Holdings’ outstanding

101⁄4percent Senior Notes due April 2001 and the $80 million of AirTran Airways’ outstanding 101⁄2percent Senior Secured Notes due April 2001. This

trans action fortifies our strategic partnership with Boeing and allows us to not only continue, but accelerate the tremendous momentum of the past

year, and we believe sets the stage for even more impressive long-term growth.

In the past twelve months, we made several strategic moves that have further built a position of strength for the Company. Increasing our overall daily

departures to 310 system-wide, and 137 in Atlanta, AirTran Airways is in an enviable position as the second largest airline at the world’s busiest airport.

AirTran Airways increased market share in Atlanta by adding flights to new markets such as Myrtle Beach, Minneapolis/St. Paul, Toledo and Pittsburgh,

while adding new nonstop service between Philadelphia and three Florida cities; Orlando, Ft. Lauderdale and Tampa. The new Pittsburgh service includes

nonstop flights to Atlanta, Chicago’s Midway Airport and New York’s LaGuardia Airport. This simultaneously decreases the airline’s dependence on our hub,

while still strengthening our position in Atlanta.

Chosen as much for their geographic location as for the fact that they are served by few airlines or monopolized by the majors, each new city has added

strength to the airline’s network by maintaining a healthy mix of business and leisure destinations. To top off our exciting expansion, we began service to our

34th city and first international destination, Grand Bahama Island, the only U.S. airline to provide service from Atlanta to Grand Bahama Island. Competing

head-to-head with the major airlines as the country’s 12th largest airline, AirTran Airways has accomplished more than growing its own profitability; we

have also directly affected the price of airfare in all of our markets–keeping air travel affordable for the traveling public in the cities we serve. In all of the

under-served, over-charged places we fly, our low fares stimulate economic growth.