Airtran 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

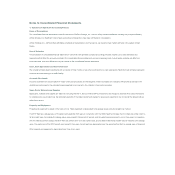

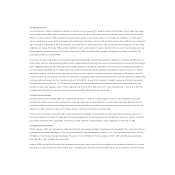

rights to acquire up to an additional 50 aircraft, additional payments could be required beginning in 2001. In conjunction with these contractual commitments,

we have made non-refundable deposits of approximately $26.2 million at December 31, 2000.

In November 1997, we filed a suit against SabreTech and its parent corporation seeking to hold them responsible for the accident involving Flight 592.

On September 23, 1999, we settled the lawsuit against SabreTech and its parent. The net proceeds of $19.6 million from the settlement are included in

other revenue in the 1999 statement of operations.

Several stockholder class action suits were filed against us and certain of our current and former executive officers and directors. The suits were subsequently

consolidated into a single action. On December 31, 1998, we entered into a Memorandum of Understanding to settle the consolidated lawsuit. Although

we denied that we violated any of our obligations under the federal securities laws, we paid $2.5 million in cash and $2.5 million in common stock in the

settlement which was approved on October 28, 1999.

From time to time, we are engaged in other litigation arising in the ordinary course of our business. We do not believe that any such pending litigation will have

a material adverse effect on our results of operations or financial condition.

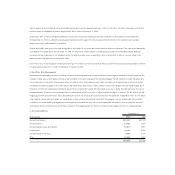

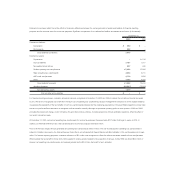

3. Fuel Price Risk Management

We entered into fuel-hedging contracts consisting of fixed-price swap agreements and collar structures to protect against increases in aircraft fuel prices. The

change in market value of such agreements has a high correlation to the price changes of the fuel being hedged. Periodic settlements under the agreements

are recognized as a component of fuel expense when the underlying fuel being hedged is used. Gains and losses on the agreements would be recognized

immediately should the changes in the market value of the agreements cease to have a high correlation to the price changes of the fuel being hedged. As of

December 31, 2000, we hedged approximately 50 percent of our projected first quarter 2001 fuel needs at a price no higher than $29 per barrel of crude oil,

and approximately 30 percent of our projected needs for the remainder of 2001 at a price no higher than $24 per barrel of crude oil. The fair value of our fuel

hedging agreements at December 31, 2000, representing the amount we would receive upon termination of the agreement, totaled $0.8 million. If in the future

a fuel-hedging contract were terminated, any resulting gain or loss would be deferred and amortized to fuel expense over the remaining life of the contract.

A default by the broker-dealer to an agreement would expose us to potential fuel price risk on the remaining fuel purchases, in that we would be required to

purchase fuel at the current fuel price, rather than according to the hedging agreement. We do not enter into fuel-hedging contracts for trading purposes.

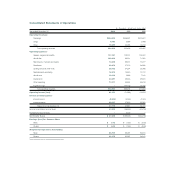

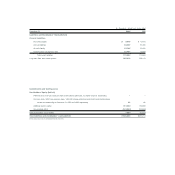

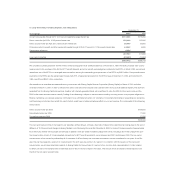

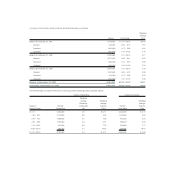

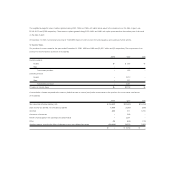

4. Accrued Liabilities

December 31,

(In thousands) 2000 1999

Accrued maintenance $19,307 $24,278

Accrued interest 13,105 9,447

Accrued salaries, wages and benefits 10,617 8,961

Deferred gain 10,122 6,300

Accrued federal excise taxes 4,348 2,176

Other 10,550 6,294

$68,049 $57,456