Airtran 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To the extent we do not utilize the lease financing commitment (or such commitment is unavailable because of expiry or otherwise), we will be required to

obtain a portion of the B717 financing from sources other than Boeing Capital. We believe that, with the support to be provided by Boeing and its affiliates

(from the lease financing commitment and other provisions of the B717 purchase agreement), aircraft-related debt and/or lease financing should be available

when needed. However, we cannot assure investors that we will be able to secure financing on terms attractive to us, if at all. To the extent we cannot secure

acceptable financing, we may be required to modify our aircraft acquisition plans or to incur financing costs higher than anticipated.

In addition, in partial consideration of the refinancing transactions, we have granted Boeing an option to cause us to purchase or lease up to four additional

B717 aircraft per year during 2001, 2002 and 2003. If we elect to lease, Boeing Capital will provide financing substantially equivalent to the lease financing

commitment. These aircraft, and Boeing Capital’s commitment to provide financing thereof, are supplemental to the 50 firm aircraft which are the subject of

our existing purchase agreement with Boeing.

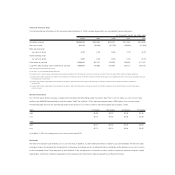

Recently Issued Accounting Standards

In June 1998, the FASB issued SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended in June 2000 by SFAS No. 138,

Accounting for Certain Derivative Instruments and Certain Hedging Activities, which requires companies to recognize all derivatives as either assets or lia-

bilities in the balance sheet and measure such instruments at fair value. As amended by SFAS No. 137, Accounting for Derivative Instruments and Hedging

Activities –

Deferral of the Effective Date of FASB Statement No. 133, we will adopt SFAS No. 133 effective January 1, 2001. Adoption of these new accounting

standards will result in a cumulative after-tax reduction to net income of approximately $0.3 million, and an increase to other comprehensive income of

approximately $0.8 million, in the first quarter of 2001. The adoption will also impact assets and liabilities recorded on the balance sheet. The ongoing effects

will depend upon future market conditions and our hedging activities.

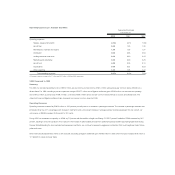

Forward-Looking Statements

The statements that are contained in this Report that are not historical facts are “forward-looking statements” which can be identified by the use of forward-

looking terminology such as “expects,” “intends,” “believes,” “will,” or the negative thereof, or other variations thereon or comparable terminology.

We wish to caution the reader that the forward-looking statements contained in this Report are only estimates or predictions, and are not historical facts.

Such statements include, but are not limited to:

•our performance in future periods;

•our ability to maintain profitability and to generate working capital from operations;

•our ability to take delivery of and to finance aircraft;

•our ability to restructure and/or refinance our indebtedness;

•the adequacy of our insurance coverage; and

•the results of litigation or investigations.