Airtran 2000 Annual Report Download - page 27

Download and view the complete annual report

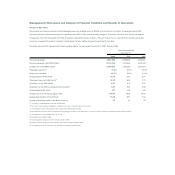

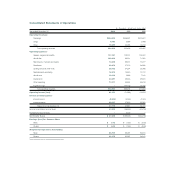

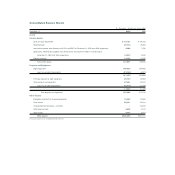

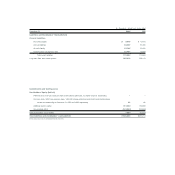

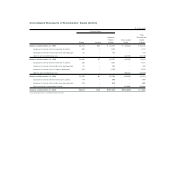

Please find page 27 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of December 31, 2000, our cash and cash equivalents including restricted cash increased by $27.7 million from December 31, 1999. Net cash provided by

operating activities was $69.4 million in 2000 compared to $75.7 million in 1999, which included a 1999 litigation settlement gain of $19.6 million. Excluding the

gain, our net cash from operating activities increased by $13.3 million. The increase in operating cash flows was primarily the result of an increase in operating

income. Cash provided by operating activities in 2000 was primarily used for debt service. Net cash provided by investing activities was $3.7 million, which

primarily related to the sale of two B717s and the use of unexpended debt proceeds from 1999 offset by the acquisition of two B717s and the scheduled progress

payments for future B717 aircraft deliveries. Cash used for financing activities was $53.1 million, which primarily related to the payment of long-term debt.

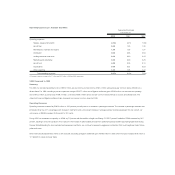

Initially, we contracted with an affiliate of Boeing to purchase 50 B717 aircraft for delivery between 1999 and 2002, with options to purchase an additional 50

B717s. During the second quarter of 2000, we revised our contracts with Boeing relating to the purchase and financing of our future B717 aircraft deliveries.

The revised contract provides for a delivery schedule as follows: 1999 (eight aircraft – all delivered), 2000 (eight aircraft – all delivered), 2001 (12 aircraft),

2002 (12 aircraft), and 2003 (10 aircraft). In connection with our agreement with Boeing, we also recharacterized the 50 option aircraft to provide for

25 options, 20 purchase rights, and five rolling options. The options and purchase rights, to the extent exercised, would provide for delivery to us of all

of our B717s on or before September 30, 2005. Prior to this revision, we had committed to purchase 50 B717 aircraft during the following years: 1999

(eight aircraft), 2000 (eight aircraft), 2001 (16 aircraft), and 2002 (18 aircraft). Also prior to the revision, the 50 option aircraft, if exercised, would have been available

for delivery between January 2003 and January 2005.

During the third quarter of 1998, we reached an agreement with Boeing to defer the progress payments due and payable prior to the first delivery until the

first delivery, which occurred in September 1999. Accordingly, progress payments resumed in September 1999, and we paid $6.8 million and $6.6 million in

progress payments in 2000 and 1999, respectively. In 2000, we again deferred certain progress payments. There can be no assurance that cash provided

by operations will be sufficient to meet the progress payments for future B717 deliveries. If we exercise our options and purchase rights to acquire up to an

additional 50 B717 aircraft, additional payments could be required for these aircraft beginning in 2001.

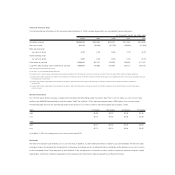

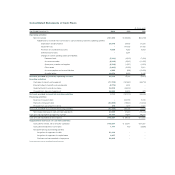

As of December 31, 2000, our debt related to asset financing totaled $277.9 million, with respect to which aircraft and certain other equipment are pledged

as security. Included in such amount is $131.8 million of 10.63 percent EETCs, of which a portion of interest and principal is payable semi-annually through

April 2017 and $80.0 million of 10.50 percent senior secured notes due April 2001. In addition, we have $150.0 million of 10.25 percent senior notes due

April 2001.

The EETC proceeds were used to replace loans for the purchase of the first ten B717 aircraft delivered, and all ten aircraft were pledged as collateral for the

EETCs. Eight EETC-financed B717s were delivered in 1999, and the remaining two deliveries occurred in 2000. During 2000, we sold and leased back two of

the EETC-financed B717s in a leveraged lease transaction reducing the outstanding principal amount of the EETCs by $35.9 million. Unexpended proceeds

from the EETCs issue were $0 and $39.2 million at December 31, 2000, and December 31, 1999, respectively.

During 2000, we took delivery of eight new B717 aircraft that were financed as follows: two were delivered and subsequently sold and leased back from the

lessors (as discussed in the immediately preceding paragraph); three were leased from an affiliate of the airframe manufacturer; and three were purchased with

promissory notes provided by an affiliate of the airframe manufacturer (the promissory notes were fully repaid in February 2001).

We entered into an amended and restated financing commitment with Boeing Capital Services Corporation (Boeing Capital) on March 9, 2001, as further

amended on March 21, 2001, in order to refinance the senior notes and senior secured notes due April 2001 and to provide additional liquidity. The cash

flow generated from the Boeing Capital transactions, together with internally generated funds, will be sufficient to retire the $150.0 million senior notes and