Airtran 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

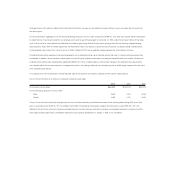

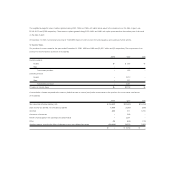

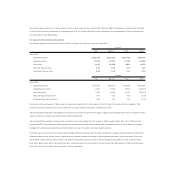

$427,903

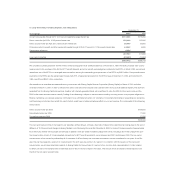

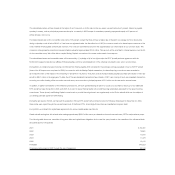

6. Leases

Total rental expense charged to operations for aircraft, facilities and office space for the years ended December 31, 2000, 1999 and 1998, was approximately

$30.9 million, $21.7 million and $23.9 million, respectively.

We lease six DC-9s, one B737, and five B717s under operating leases with terms that expire through 2018. We have the option to renew the DC-9 leases for

one or more periods of not less than six months. We have the option to renew the B717 leases for periods ranging from one to four years. The B717 leases

have purchase options at or near the end of the lease term at fair market value, and two have purchase options based on a stated percentage of the lessor’s

defined cost of the aircraft at the end of the thirteenth year of the lease term. We also lease facilities from local airport authorities or other carriers, as well as

office space under operating leases with terms ranging from one month to thirteen years. In addition, we lease ground equipment and certain rotables under

capital leases.

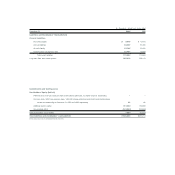

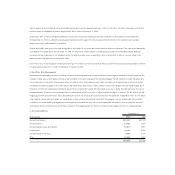

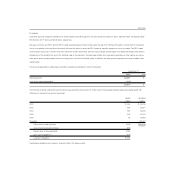

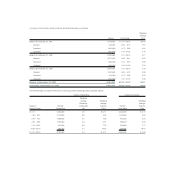

The amounts applicable to capital leases included in property and equipment were (in thousands):

December 31,

2000 1999

Flight equipment $2,627 $ –

Less: Accumulated depreciation (111) –

$2,516 $ –

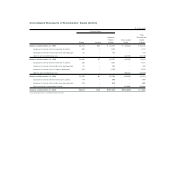

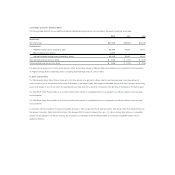

The following schedule outlines the future minimum lease payments at December 31, 2000, under noncancelable operating leases and capital leases with

initial terms in excess of one year (in thousands):

Capital Operating

Leases Leases

2001 $ 546 $ 33,015

2002 568 33,571

2003 564 34,233

2004 535 27,274

2005 95 25,969

Thereafter – 189,467

Total minimum lease payments 2,308 $343,529

Less: amount representing interest (274)

Present value of future payments 2,034

Less: current obligations (437)

Long-term obligations $1,597

Capital lease obligations are included in long-term debt in the balance sheet.