Airtran 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

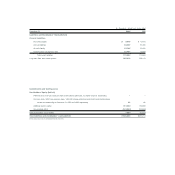

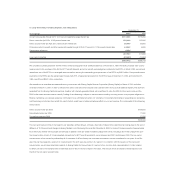

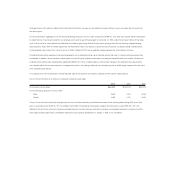

The estimated salvage values and depreciable lives are periodically reviewed for reasonableness, and revised if necessary. At January 1, 1998, we revised the

salvage values and useful lives on our DC-9 fleet and related equipment as outlined below:

1997 1998 1997 1998

Salvage Value Salvage Value Useful Life Useful Life

Airframes 10% 40% 10-20 years 10-12 years

Engines 10% 10% 3 years 10-12 years

Aircraft parts 5-50% 5% 3 years fleet life

The revised salvage value of our DC-9 fleet ranged from approximately $0.4 million to $2.6 million per aircraft. The effect of this change for the year ended

December 31, 1998, was to increase income by approximately $12 million or $0.19 per share. At the time, these estimates more accurately reflected our

expectations of estimated fair values at the anticipated dates of disposal.

Measurement of Impairment

In accordance with Statement of Financial Accounting Standard (SFAS) No. 121, Accounting for the Impairment of Long-Lived Assets and for Long-Lived

Assets to be Disposed of, we record impairment losses on long-lived assets used in operations when events or circumstances indicate that the assets may

be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the net book value of those assets. See Note 10.

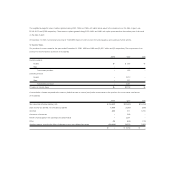

Intangibles

The trade name and intangibles resulting from business acquisitions consist of cost in excess of net assets acquired, and are being amortized using the

straight-line method over 30 years. Accumulated amortization at December 31, 2000 and 1999, was approximately $5.1 million and $3.7 million, respectively.

The carrying value of cost in excess of net assets acquired is reviewed for impairment whenever events or changes in circumstances indicate that it may

not be recoverable. If such an event occurred, we would prepare projections of future results of operations for the remaining amortization period. If such

projections indicated that the expected future net cash flows (undiscounted and without interest) are less than the carrying amount of cost in excess of net

assets acquired, we would record an impairment loss in the period such determination is made, based on the fair value of the related business.

Capitalized Interest

Interest attributable to funds used to finance the acquisition of new aircraft is capitalized as an additional cost of the related asset. Interest is capitalized at our

weighted average interest rate on long-term debt or, where applicable, the interest rate related to specific borrowings. Capitalization of interest ceases when

the asset is placed in service. In 2000, 1999 and 1998, approximately $8.8 million, $6.7 million and $3.3 million of interest cost was capitalized, respectively.

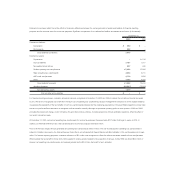

Aircraft and Engine Maintenance

We account for airframe and engine overhaul costs using the direct-expensing method. Overhauls are performed on a continuous basis, and the cost of

overhauls and routine maintenance costs for airframe and engine maintenance are charged to maintenance expense as incurred.

Advertising Costs

Advertising costs are charged to expense in the period the costs are incurred. Advertising expense was approximately $15.7 million, $14.8 million and

$14.8 million for the years ended December 31, 2000, 1999 and 1998, respectively.