Whole Foods 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

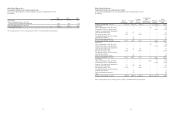

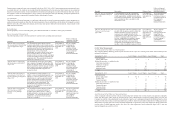

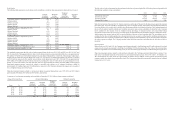

Minimum rental commitments and sublease rental income required by all noncancelable leases are approximately as follows

(in millions):

Capital Operating Sublease

Fiscal year 2016 $ 6 $ 430 $ 8

Fiscal year 2017 7 493 8

Fiscal year 2018 5 525 6

Fiscal year 2019 5 530 5

Fiscal year 2020 5 536 4

Future fiscal years 74 6,388 6

102 $ 8,902 $ 37

Less amounts representing interest 37

Net present value of capital lease obligations $ 65

The present values of future minimum obligations for capital leases shown above are calculated based on interest rates determined

at the inception of the lease, or upon acquisition of the original lease.

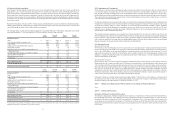

(10) Income Taxes

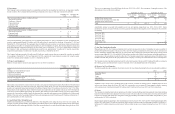

Components of income tax expense for the fiscal years indicated were as follows (in millions):

2015 2014 2013

Current federal income tax $ 310 $ 359 $ 321

Current state income tax 76 82 73

Current foreign income tax (1) 2 3

Total current tax 385 443 397

Deferred federal income tax (40) (66) (44)

Deferred state income tax (2) (10) (10)

Deferred foreign income tax (1) — —

Total deferred tax (43) (76) (54)

Total income tax expense $ 342 $ 367 $ 343

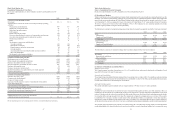

Actual income tax expense for the fiscal years indicated differed from the amount computed by applying statutory corporate

income tax rates to income before income taxes as follows (in millions):

2015 2014 2013

Federal income tax based on statutory rates $ 307 $ 331 $ 313

Increase (reduction) in income taxes resulting from:

Tax-exempt interest (1) (1) (1)

Excess charitable contributions (9) (8) (7)

Federal income tax credits (3) (3) (2)

Other, net 2 2 —

Total federal income taxes 296 321 303

State income taxes, net of federal income tax benefit 48 47 41

Tax impact of foreign operations (2) (1) (1)

Total income tax expense $ 342 $ 367 $ 343

Current income taxes receivable were not material at September 27, 2015 or September 28, 2014.

48

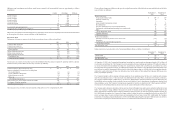

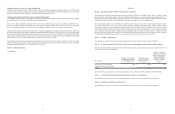

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities

were as follows (in millions):

September 27,

2015

September 28,

2014

Deferred tax assets:

Compensation-related costs $ 207 $ 159

Insurance-related costs 59 53

Inventories 2—

Lease and other termination accruals 11 13

Rent differential 170 156

Tax basis of fixed assets in excess of financial basis 11 9

Net domestic and international operating loss carryforwards 23 20

Other 15 8

Gross deferred tax assets 498 418

Valuation allowance (35) (30)

Deferred tax assets 463 388

Deferred tax liabilities:

Financial basis of fixed assets in excess of tax basis (117) (79)

Inventories —(5)

Capitalized costs expensed for tax purposes (3) (4)

Deferred tax liabilities (120) (88)

Net deferred tax asset $ 343 $ 300

Deferred taxes have been classified on the Consolidated Balance Sheets as follows (in millions):

September 27,

2015

September 28,

2014

Current assets $ 199 $ 168

Noncurrent assets 144 132

Net deferred tax asset $ 343 $ 300

At September 27, 2015, the Company had international operating loss carryforwards totaling approximately $115 million, all

of which have an indefinite life. The Company provided a valuation allowance totaling approximately $35 million for deferred

tax assets associated with international operating loss carryforwards, federal credit carryforwards, and deferred tax assets

associated with unrecognized tax benefits, for which management has determined it is more likely than not that the deferred tax

asset will not be realized. Management believes that it is more likely than not that we will fully realize the remaining domestic

deferred tax assets in the form of future tax deductions based on the nature of these deductible temporary differences and a

history of profitable operations.

The Company intends to utilize earnings in foreign operations for an indefinite period of time, or to repatriate such earnings

only when tax-efficient to do so. If these amounts were distributed to the United States, in the form of dividends or otherwise,

the Company would be subject to additional U.S. income taxes. Determination of the amount of unrecognized deferred income

tax liabilities on these earnings is not practicable because such liability, if any, is dependent on circumstances existing if and

when remittance occurs. The Company’s total gross unrecognized tax benefits are classified in the “Other long-term liabilities”

line item on the Consolidated Balance Sheets and were not material during the last three fiscal years.

The Company and its domestic subsidiaries file income tax returns with federal, state and local tax authorities within the United

States. The Company’s foreign affiliates file income tax returns in Canada and the United Kingdom. The IRS of the United

States completed its examination of the Company’s federal tax returns for fiscal year 2013 during the first quarter of fiscal year

2015. With limited exceptions, the Company is no longer subject to federal income tax examinations for fiscal years before 2013

and is no longer subject to state and local income tax examinations for fiscal years before 2008. Additionally, the Company

entered into a Compliance Agreement Program (“CAP”) with the IRS under which the Company’s federal income tax return is

reviewed and accepted by the Internal Revenue Service in conjunction with the filing of its tax return.