Whole Foods 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Foreign currency gains and losses were not material in fiscal year 2015, 2014 or 2013. Intercompany transaction gains and losses

associated with our U.K. operations are excluded from the determination of net income since these transactions are considered

long-term investments in nature. Assets and liabilities are translated at exchange rates in effect at the balance sheet date. Income

and expense accounts are translated at the average exchange rates during the fiscal year. Resulting translation adjustments are

recorded as a separate component of accumulated other comprehensive income.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to

make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements, and revenues and expenses during the period reported. Actual amounts could

differ from those estimates.

Reclassifications

Where appropriate, we have reclassified prior years’ financial statements to conform to current year presentation.

Recent Accounting Pronouncements

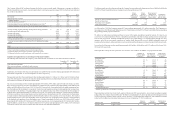

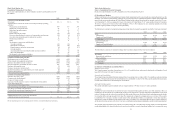

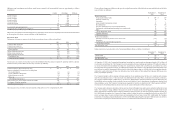

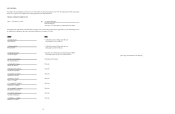

The following table provides a brief description of recently issued accounting pronouncements:

Standard Description Effective Date

Effect on financial

statements and other

significant matters

ASU No. 2015-16 Simplifying

the Accounting for Measurement

- Period Adjustments (Topic

805)

The amendments require that an acquirer

recognize adjustments to provisional amounts

identified during the measurement period in the

reporting period in which the adjustments are

determined and eliminates the requirement to

retrospectively revise prior periods.

Additionally, an acquirer should record in the

same period the effects on earnings of any

changes in the provisional accounts, calculated

as if the accounting had been completed at the

acquisition date. The amendments should be

applied on a prospective basis.

First quarter of

fiscal year ending

September 24,

2017

We are currently

evaluating the

impact that the

adoption of these

provisions will have

on the Company’s

consolidated

financial statements.

ASU No. 2015-11 Simplifying

the Measurement of Inventory

(Topic 330)

The amendments, which apply to inventory

that is measured using any method other than

the last-in, first-out (LIFO) or retail inventory

method, require that entities measure inventory

at the lower of cost and net realizable value.

The amendments should be applied on a

prospective basis.

First quarter of

fiscal year ending

September 30,

2018

We are currently

evaluating the

impact that the

adoption of these

provisions will have

on the Company’s

consolidated

financial statements.

ASU No. 2015-05 Customer’s

Accounting for Fees Paid in a

Cloud Computing Arrangement

(Topic 350)

The amendments provide guidance as to

whether a cloud computing arrangement (e.g.,

software as a service, platform as a service,

infrastructure as a service, and other similar

hosting arrangements) includes a software

license and, based on that determination, how

to account for such arrangements. The

amendments may be applied on either a

prospective or retrospective basis and early

adoption is permitted.

First quarter of

fiscal year ending

September 24,

2017

We are currently

evaluating the

impact that the

adoption of these

provisions will have

on the Company’s

consolidated

financial statements.

ASU No. 2015-03 Simplifying

the Presentation of Debt

Issuance Costs (Subtopic

835-30)

The amendments require that debt issuance

costs related to a recognized liability be

presented in the balance sheet as a direct

deduction from the carrying amount of that

debt liability. The amendments should be

applied on a retrospective basis and early

adoption is permitted.

First quarter of

fiscal year ending

September 24,

2017

We do not expect the

adoption of these

provisions to have a

significant impact on

the Company’s

consolidated

financial statements.

44

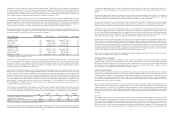

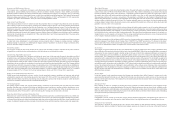

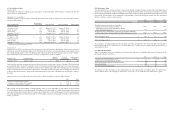

Standard Description Effective Date

Effect on financial

statements and other

significant matters

ASU No. 2015-02 Amendments

to the Consolidation Analysis

(Topic 810)

The amendments revise the consolidation

analysis related to limited partnerships and

similar legal entities, variable interest entities,

and certain investment funds. The amendments

may be applied on either a modified or full

retrospective basis.

First quarter of

fiscal year ending

September 24,

2017

We do not expect the

adoption of these

provisions to have a

significant impact on

the Company’s

consolidated

financial statements.

ASU No. 2014-09 Revenue from

Contracts with Customers

(Topic 606)

The core principle of the new guidance is that

an entity will recognize revenue to depict the

transfer of promised goods or services to

customers in an amount that reflects the

consideration to which the entity expects to be

entitled in exchange for those goods or

services. Additionally, the guidance requires

disclosures related to the nature, amount,

timing, and uncertainty of revenue that is

recognized. The amendments may be applied

on either a full or modified retrospective basis.

First quarter of

fiscal year ending

September 30,

2018 or fiscal

year ending

September 29,

2019

We are currently

evaluating the

timing, method, and

impact that the

adoption of these

provisions will have

on the Company’s

consolidated

financial statements.

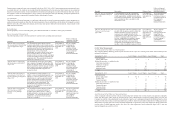

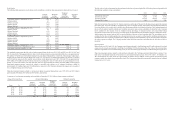

(3) Fair Value Measurements

Assets Measured at Fair Value on a Recurring Basis

The Company held the following financial assets measured at fair value on a recurring basis based on the hierarchy levels

indicated (in millions):

September 27, 2015 Level 1 Inputs Level 2 Inputs Level 3 Inputs Total

Cash equivalents:

Money market fund $ 32 $ — $ — $ 32

Marketable securities - available-for-sale:

Asset-backed securities — 13 — 13

Certificates of deposit — 2 — 2

Corporate bonds — 30 — 30

Municipal bonds — 173 — 173

Total $ 32 $ 218 $ — $ 250

September 28, 2014 Level 1 Inputs Level 2 Inputs Level 3 Inputs Total

Cash equivalents:

Money market fund $ 46 $ — $ — $ 46

Treasury bills 4 — — 4

Commercial paper — 15 — 15

Marketable securities - available-for-sale:

Asset-backed securities — 13 — 13

Commercial paper — 33 — 33

Corporate bonds — 97 — 97

Municipal bonds — 530 — 530

Total $ 50 $ 688 $ — $ 738

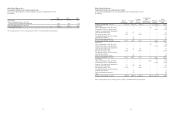

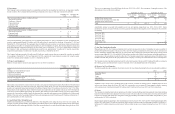

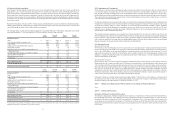

Assets Measured at Fair Value on a Nonrecurring Basis

Assets recognized or disclosed at fair value on a nonrecurring basis include items such as property and equipment, intangible

assets, and other assets. These assets are measured at fair value if determined to be impaired. During fiscal year 2015, the

Company recorded fair value adjustments, based on hierarchy input Level 3, totaling approximately $46 million related to certain

locations for which asset value exceeded expected future cash flows, which were primarily included in the “Selling, general and

administrative expenses” line item on the Consolidated Statements of Operations. These asset impairment charges reduced the

carrying value of related long-term assets to fair value. Fair value adjustments, based on hierarchy input Level 3, were not

material during fiscal year 2014 or 2013.