Whole Foods 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

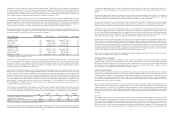

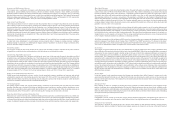

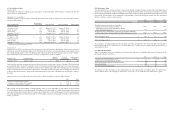

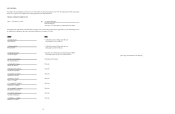

(4) Investments

The Company holds investments primarily in marketable securities that are classified as either short- or long-term available-

for-sale securities. The Company held the following investments at fair value as of the dates indicated (in millions):

September 27,

2015

September 28,

2014

Short-term marketable securities - available-for-sale:

Asset-backed securities $ 10 $ 9

Certificates of deposit 2—

Commercial paper —33

Corporate bonds 15 56

Municipal bonds 128 455

Total short-term marketable securities $ 155 $ 553

Long-term marketable securities - available-for-sale:

Asset-backed securities $ 3 $ 4

Corporate bonds 15 41

Municipal bonds 45 75

Total long-term marketable securities $ 63 $ 120

Gross unrealized holding gains and losses were not material at September 27, 2015 or September 28, 2014. Available-for-sale

securities totaling approximately $58 million and $142 million were in unrealized loss positions at September 27, 2015 and

September 28, 2014, respectively. The aggregate value of available-for-sale securities in a continuous unrealized loss position

for greater than 12 months was not material at September 27, 2015 or September 28, 2014. The Company did not recognize any

other-than-temporary impairments during the last three fiscal years. At September 27, 2015, the average effective maturity of

the Company’s short- and long-term available-for-sale securities was approximately 7 months and 16 months, respectively,

compared to approximately 6 months and 15 months, respectively, at September 28, 2014.

The Company held approximately $14 million and $10 million in equity interests that are accounted for using the cost method

of accounting at September 27, 2015 and September 28, 2014, respectively. Equity interests accounted for using the equity

method were not material at September 27, 2015 or September 28, 2014.

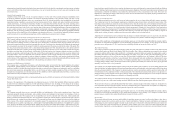

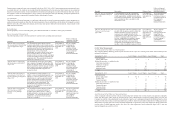

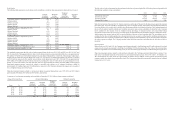

(5) Property and Equipment

Balances of major classes of property and equipment were as follows (in millions):

September 27,

2015

September 28,

2014

Land $ 151 $ 139

Buildings and leasehold improvements 3,116 2,628

Capitalized real estate leases 81 81

Fixtures and equipment 2,330 2,099

Construction in progress and equipment not yet in service 176 362

Property and equipment, gross 5,854 5,309

Less accumulated depreciation and amortization (2,691) (2,386)

Property and equipment, net of accumulated depreciation and amortization $ 3,163 $ 2,923

Depreciation and amortization expense related to property and equipment totaled approximately $422 million, $360 million and

$324 million for fiscal years 2015, 2014 and 2013, respectively. During fiscal year 2015, asset impairment charges related to

property and equipment totaled approximately $48 million primarily related to locations as discussed in Note 3, Fair Value

Measurements. Asset impairment charges related to property and equipment were not material in fiscal year 2014. Development

costs of new locations totaled approximately $516 million, $447 million and $339 million in fiscal years 2015, 2014 and 2013,

respectively. Construction accruals related to development sites, remodels, and expansions were included in the “Other current

liabilities” line item on the Consolidated Balance Sheets and totaled approximately $54 million and $116 million at September 27,

2015 and September 28, 2014, respectively.

(6) Goodwill and Other Intangible Assets

Additions and adjustments to goodwill and additions to other intangible assets during fiscal year 2015 were not material. The

Company recorded goodwill totaling approximately $29 million related to the acquisition of four retail locations and definite-

lived intangible assets totaling approximately $18 million, primarily related to acquired leasehold rights, during fiscal year 2014.

46

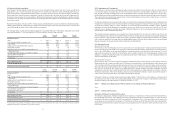

There were no impairments of goodwill during fiscal years 2015, 2014 or 2013. The components of intangible assets as of the

dates indicated were as follows (in millions):

September 27, 2015 September 28, 2014

Gross carrying

amount

Accumulated

amortization

Gross carrying

amount

Accumulated

amortization

Definite-lived contract-based $ 122 $ (50) $ 120 $ (45)

Definite-lived marketing-related and other — — 1 (1)

Indefinite-lived contract-based 7 6

Total $ 129 $ (50) $ 127 $ (46)

Amortization expense associated with intangible assets was not material during fiscal year 2015, 2014 or 2013. Future

amortization expense associated with the net carrying amount of definite-lived intangible assets is estimated to be as follows

(in millions):

Fiscal year 2016 $6

Fiscal year 2017 6

Fiscal year 2018 5

Fiscal year 2019 5

Fiscal year 2020 4

Future fiscal years 46

Total $72

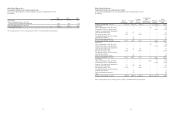

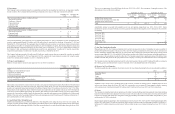

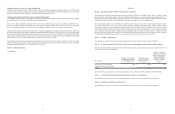

(7) One-Time Termination Benefits

During fiscal year 2015, the Company communicated to certain team members its plan of termination to reduce a number of

positions through the first quarter of fiscal year 2016 as part of its ongoing commitment to lower prices for its customers and

invest in technology upgrades while improving its cost structure. The Company has reduced more than 2,000 positions, which

represents approximately 2.1% of its workforce. Affected team members were offered several options, including transition pay,

severance pay, or the opportunity to apply for other jobs. The Company expects that a significant portion of the affected team

members will find other jobs from the open positions in the Company or via new jobs created from new stores in development.

The Company recorded one-time termination benefits in the fourth quarter of fiscal year 2015 totaling $34 million, included in

the “Selling, general, and administrative expenses” line item on the Consolidated Statements of Operations.

(8) Reserves for Closed Properties

The following table provides a summary of activity in reserves for closed properties during the fiscal years indicated (in millions):

2015 2014

Beginning balance $ 31 $ 36

Additions 94

Usage (13) (11)

Adjustments 12

Ending balance $ 28 $ 31

Additions to store closure reserves primarily relate to the accretion of interest on existing reserves. Additions related to seven

and two new closures during fiscal years 2015 and 2014, respectively, were not material. Usage primarily related to ongoing

cash rental payments totaled approximately $13 million and $11 million for fiscal years 2015 and 2014, respectively.

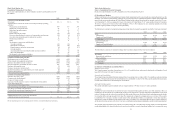

(9) Leases

The Company is committed under certain capital leases for rental of certain buildings, land and equipment, and certain operating

leases for rental of facilities and equipment. These leases expire or become subject to renewal clauses at various dates from 2015

to 2054. The Company had capital lease obligations totaling approximately $65 million and $62 million at September 27, 2015

and September 28, 2014, respectively.

Rental expense charged to operations under operating leases for fiscal years 2015, 2014 and 2013 totaled approximately $441

million, $407 million and $374 million, respectively, which included contingent rentals totaling approximately $14 million, $13

million and $13 million during those same periods. Sublease rental income was not material during fiscal year 2015, 2014 or

2013.