Whole Foods 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Whole Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

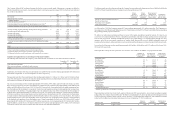

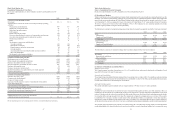

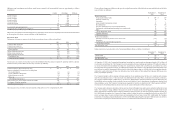

Insurance and Self-Insurance Reserves

The Company uses a combination of insurance and self-insurance plans to provide for the potential liabilities for workers’

compensation, general liability, property insurance, director and officers’ liability insurance, vehicle liability, and employee

health care benefits. Liabilities associated with the risks that are retained by the Company are estimated, in part, by considering

historical claims experience, demographic factors, severity factors and other actuarial assumptions. The Company had insurance

liabilities totaling approximately $170 million and $152 million at September 27, 2015 and September 28, 2014, respectively,

included in the “Other current liabilities” line item on the Consolidated Balance Sheets.

Reserves for Closed Properties

The Company maintains reserves for retail stores and other properties that are no longer being utilized in current operations.

The Company provides for closed property operating lease liabilities using the present value of the remaining noncancelable

lease payments and lease termination fees after the closing date, net of estimated subtenant income. The closed property lease

liabilities are expected to be paid over the remaining lease terms, which generally range from three months to nine years. The

Company estimates subtenant income and future cash flows based on the Company’s experience and knowledge of the area in

which the closed property is located, the Company’s previous efforts to dispose of similar assets and existing economic conditions.

Reserves for closed properties are included in the “Other current liabilities” and “Other long-term liabilities” line items on the

Consolidated Balance Sheets.

The reserves for closed properties include management’s estimates for lease subsidies, lease terminations and future payments

on exited real estate. Adjustments to closed property reserves primarily relate to changes in existing economic conditions,

subtenant income or actual exit costs differing from original estimates. Adjustments are made for changes in estimates in the

period in which the changes become known.

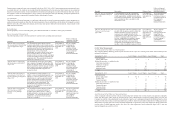

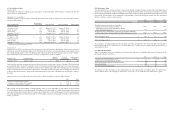

Revenue Recognition

We recognize revenue for sales of our products at the point of sale. Discounts provided to customers at the point of sale are

recognized as a reduction in sales as the products are sold. Sales taxes are not included in revenue.

Cost of Goods Sold and Occupancy Costs

Cost of goods sold includes cost of inventory sold during the period (net of discounts and allowances), distribution and food

preparation costs, and shipping and handling costs. The Company receives various rebates from third-party vendors in the form

of purchase or sales volume discounts and payments under cooperative advertising agreements. Purchase volume discounts are

calculated based on actual purchase volumes. Volume discounts and cooperative advertising discounts in excess of identifiable

advertising costs are recognized as a reduction of cost of goods sold when the related merchandise is sold. The Company utilizes

forward purchases to limit its exposures to changes in commodity prices. All forward purchase commitments are established at

current prices and recorded through cost of goods sold at settlement. Occupancy costs include store rental costs, property taxes,

utility costs, repair and maintenance costs, and property insurance. Our largest supplier, United Natural Foods, Inc., accounted

for approximately 32.0%, 31.8% and 31.6% of our total purchases in fiscal years 2015, 2014 and 2013, respectively.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist of retail operational expenses, marketing, and corporate and regional

administrative support costs. Advertising expense for fiscal years 2015, 2014 and 2013 was approximately $89 million, $63

million and $56 million, respectively. Advertising costs are charged to expense when incurred, except for certain production

costs that are charged to expense when the advertising first takes place.

Pre-opening Expenses

Pre-opening expenses include rent expense incurred during construction of new facilities and costs related to new location

openings, including costs associated with hiring and training personnel, smallwares, supplies and other miscellaneous costs.

Rent expense is generally incurred approximately nine months prior to a store’s opening date. Other pre-opening expenses are

incurred primarily in the 60 days prior to a new store opening. Pre-opening costs are expensed as incurred.

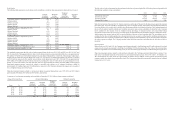

Relocation, Store Closure and Lease Termination Costs

Relocation costs consist of moving costs, estimated remaining net lease payments, accelerated depreciation costs, related asset

impairment, and other costs associated with replaced facilities. Store closure costs consist of estimated remaining lease payments,

accelerated depreciation costs, related asset impairment, and other costs associated with closed facilities. Lease termination costs

consist of estimated remaining net lease payments for terminated leases and idle properties, and associated asset impairments.

42

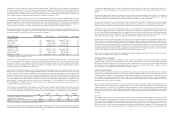

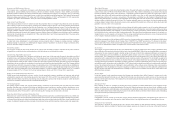

Share-Based Payments

The Company maintains several share-based incentive plans. We grant both options to purchase common stock and restricted

common stock under our Whole Foods Market 2009 Stock Incentive Plan. Options outstanding are governed by the original

terms and conditions of the grants, unless modified by a subsequent agreement. Options are granted at an option price equal to

the market value of the stock at the grant date and generally vest ratably over a four- or nine-year period beginning one year

from grant date and have a five, seven, or ten year term. The grant date is established once the Company’s Board of Directors

approves the grant and all key terms have been determined. Stock option grant terms and conditions are communicated to team

members within a relatively short period of time. The Company generally approves one primary stock option grant annually,

occurring during a trading window. Restricted common stock is granted at the market price of the stock on the day of grant and

generally vests over a four- or six-year period.

The Company uses the Black-Scholes multiple option pricing model which requires extensive use of accounting judgment and

financial estimates, including estimates of the expected term team members will retain their vested stock options before exercising

them, the estimated volatility of the Company’s common stock price over the expected term, and the number of options that will

be forfeited prior to the completion of their vesting requirements. The related share-based payment expense is recognized on a

straight-line basis over the requisite service period. The tax savings resulting from tax deductions in excess of expense reflected

in the Company’s financial statements are reflected as a financing cash flow.

All full-time team members with a minimum of 400 hours of service may purchase our common stock through payroll deductions

under the Company’s Team Member Stock Purchase Plan (“TMSPP”). The TMSPP provides for a 5% discount on the shares’

purchase date market value, which meets the share-based payment “Safe Harbor” provisions, and therefore is non-compensatory.

As a result, no compensation expense is recognized for our team member stock purchase plan.

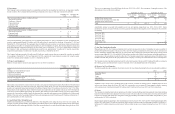

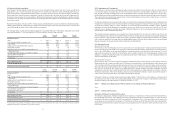

Income Taxes

The Company recognizes deferred income tax assets and liabilities by applying statutory tax rates in effect at the balance sheet

date to differences between the book basis and the tax basis of assets and liabilities. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to

reverse. Deferred tax assets and liabilities are adjusted to reflect changes in tax laws or rates in the period that includes the

enactment date. The Company may recognize the tax benefit from an uncertain tax position if it is more likely than not that the

tax position will be sustained by the taxing authorities based on technical merits of the position. The tax benefits recognized in

the financial statements from such a position are measured based on the largest benefit that has a greater than 50% likelihood

of being realized upon settlement. Significant accounting judgment is required in determining the provision for income taxes

and related accruals, deferred tax assets and liabilities. The Company believes that its tax positions are consistent with applicable

tax law, but certain positions may be challenged by taxing authorities. In the ordinary course of business, there are transactions

and calculations where the ultimate tax outcome is uncertain. In addition, we are subject to periodic audits and examinations by

the IRS and other state and local taxing authorities. Although we believe that our estimates are reasonable, actual results could

differ from these estimates.

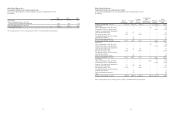

Treasury Stock

Under the Company’s stock repurchase program, the Company can repurchase shares of the Company’s common stock on the

open market that are held in treasury at cost. Shares held in treasury may be reissued to satisfy exercises of stock options and

issuances of restricted stock awards. The Company does not currently intend to retire its treasury shares. The Company’s common

stock has no par value.

Earnings per Share

Basic earnings per share are calculated by dividing net income available to common shareholders by the weighted average

number of common shares outstanding during the fiscal period. Diluted earnings per share are based on the weighted average

number of common shares outstanding plus, where applicable, the additional common shares that would have been outstanding

related to dilutive share-based awards using the treasury stock method. Dilutive potential common shares include outstanding

stock options and unvested restricted stock awards.

Comprehensive Income

Comprehensive income consists of: net income; foreign currency translation adjustments; and unrealized gains and losses on

available-for-sale securities, net of income tax, and is reflected in the Consolidated Statements of Comprehensive Income.

Foreign Currency Translation

The Company’s operations in Canada and the U.K. use their local currency as their functional currency. Foreign currency

transaction gains and losses related to Canadian intercompany operations are charged to net income in the period incurred.