Whirlpool 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

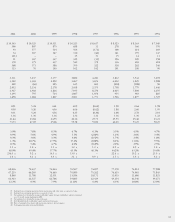

23

2002 projects, as well as the timing of promotional payments.

Combined, these negative 2003 cash outflows were essentially

offset by the absence of $239 million in product recall spending,

which occurred during 2002. Cash provided by operating activi-

ties was also negatively impacted in 2002 by a one-time tax pay-

ment of $86 million on a cross-currency interest rate swap gain,

which occurred during 2001.

The principal recurring investing activities are capital expendi-

tures to support the Company's investment in its global operating

platform to deliver innovative solutions for consumers. During

2004 and 2003, Whirlpool entered into separate sale-leaseback

transactions whereby the Company sold and leased back its

owned properties. Proceeds related to the sale-leaseback of six

properties in 2004, net of related fees, were approximately $66

million. In 2003, proceeds related to the sale-leaseback of four

properties, net of related fees, were approximately $65 million.

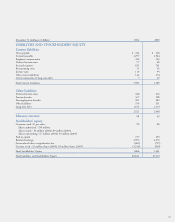

Total repayments of short-term and long-term debt, net of new

borrowings, were $58 million, $208 million and $236 million in

2004, 2003 and 2002, respectively. Dividend payments to

stockholders totaled $116 million, $94 million and $91 million

in 2004, 2003 and 2002, respectively. The Company repur-

chased approximately 3.7 million shares, 1 million shares and

0.7 million shares of Whirlpool common stock for $251 million,

$65 million and $46 million in 2004, 2003 and 2002, respec-

tively. The stock repurchases were previously authorized by the

Board of Directors.

The Company also redeemed $33 million and $25 million in

2003 and 2002, respectively, in preferred stock of its discontin-

ued finance company, Whirlpool Financial Corporation.

Whirlpool received proceeds of $64 million in 2004, $65 mil-

lion in 2003 and $80 million in 2002 related to the exercise of

Company stock options.

Financial Condition and Liquidity

The Company's objective is to finance its business through the

appropriate mix of long-term and short-term debt. Whirlpool

has varying needs for short-term working capital financing as a

result of the nature of its business. The volume and timing of

refrigeration and air-conditioning production impact the

Company's cash flows with increased production in the first half

of the year to meet increased demand in the summer months.

The Company finances its working capital needs primarily

through the commercial paper markets in the U.S., Europe and

Canada. These commercial paper programs are supported by

committed bank lines. In addition, outside the U.S., short-term

funding is also provided by bank borrowings on uncommitted

lines. The Company has access to long-term funding in the

U.S., European and other public bond markets.

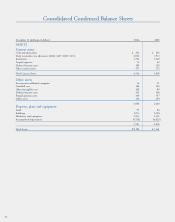

The Company's financial position remains strong. At December

31, 2004, Whirlpool's total assets were $8.2 billion versus $7.4

billion at December 31, 2003. Stockholders' equity increased

from $1.3 billion at the end of 2003 to $1.6 billion at the end

of 2004. The increase in equity is primarily attributed to net

earnings retention and a $174 million increase in equity through

foreign currency translation adjustments offset by share repur-

chases of $251 million.

The Company's overall debt levels have remained relatively

unchanged versus 2003. Cash flows from operations have been

used to repurchase stock, fund higher capital expenditures and

pay increased dividends.

In May 2004, Whirlpool allowed its $400 million committed

364-day credit facility to expire. Simultaneously, the Company

increased the size of its $800 million committed credit facility to

$1.2 billion and extended its maturity from 2006 to 2009. This

committed facility supports commercial paper programs and

other operating needs. There were no borrowings under these

facilities during 2004 or 2003. Whirlpool was in full compli-

ance with its bank covenants throughout both 2004 and 2003.

None of the Company's material debt agreements requires accel-

erated repayment in the event of a decrease in credit ratings.

In 2004, the Company announced that it plans to invest approx-

imately $180 million to strengthen Whirlpool's brand leadership

position in the global appliance industry. The Company plans

to continue its comprehensive worldwide effort to optimize its

regional manufacturing facilities, supply base, product platforms

and technology resources to better support its global brands and

customers. Approximately $100 million of the investment will

fund initiatives at the Company's manufacturing facilities in the

United States, and the remainder will be used to begin work on

the expansion of the Company's washer production facility in

Monterrey, Mexico, and the construction of a new refrigeration

facility in Ramos Arispe, Coahuila, Mexico.