Westjet 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

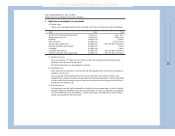

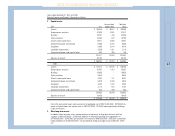

Years ended December 31, 2001 and 2000

(Tabular Amounts are Stated in Thousands of Dollars)

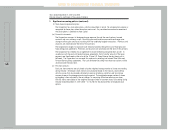

9. Risk management:

(a) Fuel risk management:

The Corporation has managed its exposure to jet fuel price volatility through the use of long-term

fixed price contracts and contracts with a fixed ceiling price which it has entered into with a fuel

supplier. Any premiums paid to enter into these long-term fuel arrangements are recorded as other

long-term assets and amortized to fuel expense over the term of the contracts. As at December 31,

2001, the Corporation had a fixed ceiling price fuel contract that is in effect through June 2003.

Based on historical and anticipated volumes of fuel usage, this contract represents approximately

35% of the Corporation’s projected 2002 fuel requirements at an indicative price of $18.61 U.S. per

barrel of crude oil.

(b) Foreign currency exchange risk:

The Corporation is exposed to foreign currency fluctuations as certain ongoing expenses are

referenced to U.S. dollar denominated prices. The Corporation periodically uses financial

instruments, including forward exchange contracts and options, to manage its exposure. At

December 31, 2001 the Corporation did not have any foreign currency contracts outstanding.

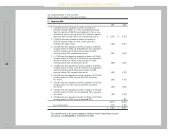

(c) Aircraft lease foreign currency exchange risk:

The Corporation has managed its exposure to fluctuations in the operating lease payments, which

are designated in U.S. dollars, for the ten Boeing next generation aircraft leases. In accordance with

the aircraft lease agreements, the U.S. dollar amount of the lease payments are fixed based on the

value of the 10-year U.S. Swap Rate on the day the aircraft is delivered. The Corporation has

managed this exposure by entering into Interest Rate Collar and Forward Starting Swap agreements.

Interest Rate Collar agreements on the first three next generation aircraft expired within the collar

range, and therefore without any financial effect to the Corporation. The fourth next generation

aircraft expired outside the collar range and incurred a loss of $1,181,000, which will be amortized

over the term of the lease. As at December 31, 2001, the fair value of the remaining six contracts,

for aircraft to be delivered between January 2002 and December 2002, was a loss of $238,971 U.S.

As a condition of these lease agreements and dependant on current fair market valuations, the

Corporation has pledged an aircraft as security and may be required to post additional cash

collateral with its counter party. The value of these agreements is derived from the yield on the 10-

year U.S. Swap Rate. The aggregate sensitivity of these agreements to changes in the 10-year U.S.

Swap Rate is $78,000 U.S. per basis point. As at December 31, 2001, the Corporation had restricted

cash of $2,750,000 U.S. on deposit with its counter party.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS