Westjet 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

particularly older jets like our 737-200

aircraft, and our appraisals conducted in

fourth quarter 2001 have confirmed a

substantial decline in market value and

potential residual values at future retirement

dates. Write-downs of WestJet’s capital

assets were not required in 2001 over and

above the already conservative estimates

we used for amortization during the year.

The major test of the value of these assets

is their revenue-generating ability. Their

value to us on our balance sheet is evident

as none of our aircraft were parked following

September 11th, and our business

recovered to normal levels very quickly in

October 2001. Our approach now is to

continue to take a conservative view of very

uncertain residual values in the future. We

will again accelerate our estimates for

amortization beginning in the first quarter of

2002, which will add about $8 million to

what would have been our amortization

expense for 2002, which translates to an

18% increase in amortization’s cost per

ASM over 2001.

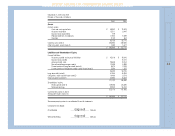

WestJet’s profitability means taxability, and

although federal and provincial rates of

taxation have been declining, this cost is a

significant portion of our pre-tax earnings at

36.2% compared with 42.6% in 2000.

There is a major timing difference between

income reported for accounting purposes,

where we amortize our aircraft over a much

longer timeframe, as compared with income

for tax purposes where aircraft are

amortized at 25% declining balance. This

timing difference creates a future tax

liability, or an accounting provision in the

current period at the then current tax rates

for the tax that will eventually be paid in

future years. When tax legislation is

enacted that lowers the tax rate, an

adjustment is made to reflect not only the

current period’s tax, but retroactive to all

prior periods’ future tax liabilities. This is

why, for accounting purposes, WestJet has

a low rate of tax for 2001. Not only did the

tax reduction benefit the current year’s

provision, but our prior years’ allowances

were also adjusted downward. We expect a

normalized tax rate of 38.5% for 2002 based

on current tax legislation.

Not only did the tax reduction benefit the current

year’s provision, but our prior years’ allowances

were also adjusted downward.

MANAGEMENT’S DISCUSSION AND ANALYSIS