Westjet 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

were online. We expanded the distribution of

our product midway through 2001 through

our partnership with the worldwide

distribution system, Sabre, and by year’s end

5% of our sales originated through this

system. Travel agents have always been a

key part of WestJet’s distribution strategy,

and through the Sales Super Centre, Sabre,

and the Internet, they account for

approximately 38% of our bookings.

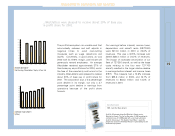

General and administration costs increased

16.7% on a per ASM basis. This category of

expenditure includes facilities costs,

professional fees, and insurance. Following

the events of September 11th, the aviation

insurers levied a charge to airlines of U.S.

$1.25 per passenger. This increased our

insurance cost in the fourth quarter by $1.9

million, and accounted for approximately one

third of our cost per ASM increase. WestJet,

like most airlines, has passed this increased

cost on to our guests in the form of a

surcharge, which is included in our revenues.

Year over year, our facilities costs for the new

hangar and the new call centre/headquarter

building in Calgary are much higher; however,

these are necessary components of

WestJet’s infrastructure to facilitate our

future growth.

In 2001, we spent an increased amount on

professional fees for our complaint and the

subsequent hearings by the Competition

Bureau – spending we deemed necessary to

be involved in the process of establishing

rules for effective competition in the airline

industry. In the fourth quarter of 2001, we

also retained our legal and tax advisors to

assist in our corporate reorganization of

WestJet Airlines Ltd. to create three wholly

owned subsidiary corporations, two of which

have formed an operating Partnership known

as ‘WestJet.’ The costs related to this

restructuring were necessary to create the

platform where risks and liability associated

with ownership of large dollar capital assets

such as aircraft, hangars, and flight simulators

were segregated, and as much as possible,

separated from the operation of the airline.

This is especially important for the future with

our planned purchases of the much larger

dollar 737-700 aircraft. There are also ancillary

tax benefits, which may accrue to WestJet in

future years as a result of this reorganization.

The wholly owned subsidiaries have been

consolidated in WestJet’s financial

statements.

MANAGEMENT’S DISCUSSION AND ANALYSIS

New Destination

YQQ - Comox, British Columbia

WestJet's second Vancouver Island destination came on board

March 3, 2001. The Comox Valley is a bustling part of Vancouver

Island, and the catchement area includes several major

communities. With six flights a week non-stop from Calgary,

Comox is quickly becoming a great getaway destination, with

golf and skiing year round. WestJet has great support from the

local community, and is pleased to bring the people of Comox an

all-jet, all-value travel option.