Westjet 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

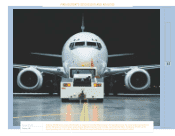

The offset to lower fuel and maintenance costs

on the new aircraft is the ownership cost. All

four 737-700s were acquired under operating

leases in 2001, while only four of our 23 737-

200s are on operating leases. Consequently,

most of our $8.5 million increase in aircraft

leasing cost in 2001 to $15.3 million relates to

the 737-700 additions. These are the first four

of a total of ten leased aircraft, with six to be

delivered in 2002, all of which are on fourteen-

year lease terms. WestJet’s total off balance

sheet asset and liabilities related to operating

leased aircraft amounts to $179 million at

December 31, 2001, as compared with $27

million at December 31, 2000. This is expected

to grow to about $423 million by December 31,

2002.

Our methodology for amortization of aircraft is

based on anticipated retirement dates, hours

flown, and residual values. With the

introduction of the 737-700 aircraft, WestJet

adjusted its accounting estimates for

amortization in 2000 on the fleet of 737-200s to

adjust for our revised retirement schedule. This

results in less time for the 737-200s in our fleet,

although not necessarily a shorter useful life for

the aircraft, prompting us to review and adjust

their residual values accordingly. Our

amortization expense more than doubled in

2000 to $18 million, and on a unit basis, was up

42.2% over the previous year.

In keeping with our annual review of residual

values of the aircraft in the fleet to ensure that

our accounting estimates continue to be

appropriate and conservative, we adjusted

residuals in 2001 and will likely conduct a

review again in 2002. There are many factors

that influence our estimates of retirement and

residual values such as the used aircraft

marketplace, current and future regulatory

directives, manufacturer bulletins, and

remaining utility time on airframes and engines.

WestJet utilizes an independent aircraft

appraisal firm as well as in-house technical

guidance and expertise to assess the accuracy

and reasonableness of the factors that

influence our accounting estimates.

The tragic events of September 11th have had

an impact on the market value of all aircraft,

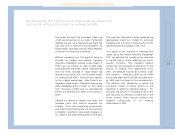

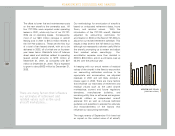

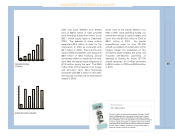

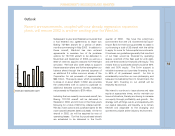

OPERATING COST PER ASM

(Unit Costs in Cents)

There are many factors that influence

our estimates of retirement and

residual values such as the used

aircraft marketplace...

MANAGEMENT’S DISCUSSION AND ANALYSIS

0

2

4

6

8

10

12

14

16

1996 1997 1998 1999 2000 2001

10.9

11.6

12.6

13.9

14.6 14.0