Westjet 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

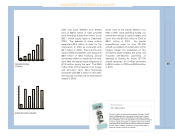

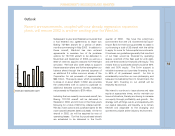

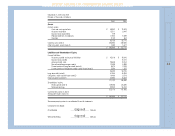

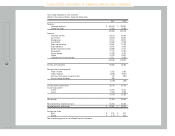

We began the year with $181 million in

shareholders’ equity and $60.4 million in debt. Our

debt to equity ratio on December 31, 2000 was

0.33 to 1.0. During 2001, shareholders’ equity

increased by $37 million from earnings to $222

million. Long-term debt and capital leases

increased by $7.2 million to $67.6 million for an

improved debt to equity ratio of 0.3 to 1.0.

Including our $179 million in off balance sheet debt

– primarily the 737-700 operating leases –

WestJet’s total debt to equity ratio is 1.1 to 1.0,

which is well below this industry’s average and our

own guidelines of a ratio below 2 to 1.

We commenced 2001 with $79 million in cash and

$1.4 million more current assets than current

liabilities. Our current ratio declined during the year

to $9.4 million fewer current assets than current

liabilities due mainly to our capital spending with

cash and particularly our pre-delivery payments to

Boeing on the future purchases of 26 737-700

aircraft. Our working capital remains strong, and

has been substantially enhanced with a recently

announced equity issue.

Cash provided from operations was down from

$87.4 million in 2000 to $67.4 million in 2001. Our

non-cash adjusted net earnings contributed a

47.3% increase to cash of $76.5 million as

compared with $51.9 million in the previous year.

WestJet’s non-cash working capital declined by

$9.1 million as compared with an increase of $35.5

million in 2000. This was due to the increase in size

of our income tax installments, or prepayments of

2001 tax, and our December renewal of aviation

insurance and prepayment in that month of our

next year’s premiums. There was also the anomaly

of the timing differences of cheque runs to our

accounts payable suppliers (i.e. just after the year-

end in 2000 and just prior in 2001).

Financial Condition

Maintaining a low-cost structure and a strong balance sheet are two

important and related pillars of our business plan.

MANAGEMENT’S DISCUSSION AND ANALYSIS

New Destination

YMM - Fort McMurray, Alberta

WestJet first flew to "Fort Mac" on January 8, 2001. It was a logical

addition to WestJet's Western Canada service, connecting Fort

McMurray's bustling oil and gas economy with Edmonton and

Calgary, with connections to the rest of the network. Our fourth

Alberta destination, Fort McMurray further solidifies our presence

in the West, and it marks our return to a market we had previously

served. With friendly service and the only all-jet service in town, the

people in Fort McMurray are happy to have us back - and we’re

glad to be there.