Vodafone 1998 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 1998 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

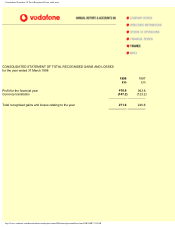

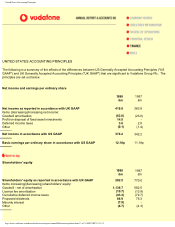

United States Accounting Principles

Shareholders' equity in accordance with US GAAP 1,439.5 1,336.9

Total assets

1998 1997

£m £m

Total assets as reported in accordance with UK GAAP 2,502.3 2,421.8

Items increasing/(decreasing) total assets:

Goodwill - net of amortisation 1,136.7 582.5

Defeased - liabilities 340.5 -

Deferred tax asset 57.0 30.9

Licence fee amortisation (10.7) (13.9)

Other 0.2 (2.1)

Total assets in accordance with US GAAP 4,026.0 3,019.2

Summary of differences between accounting principles generally accepted in the UK and the US

The consolidated financial statements are prepared in accordance with accounting principles generally accepted in the

UK ("UK GAAP"), which differ in certain material respects from those generally accepted in the US ("US GAAP"). The

differences that are material to the Group relate to the following items and the necessary adjustments are shown above.

Goodwill

Under UK GAAP, the Group has written-off such goodwill against shareholders' equity in the fiscal year of acquisition.

Under US GAAP, goodwill must be capitalised and amortised against income over the estimated period of benefit, but not

in excess of 40 years. Accordingly, goodwill is amortised over a period not exceeding 40 years.

Investments in associated undertakings can also include an element of goodwill in the amount of the excess of the

investment over Vodafone Group Plc's share in the fair value of the net assets at the date of investment. For US GAAP

purposes the Group capitalises and amortises goodwill over the estimated period of benefit. The Group's equity in

earnings of the associated undertakings for US GAAP purposes is reduced by the amortisation of such goodwill.

Licence fee amortisation

Under UK GAAP, licence fees are amortised in proportion to the expected usage of the network during the start up period

and then on a straight line basis. Under US GAAP, licence fees are amortised on a straight line basis from the date of

acquisition.

Deferred taxation

Under UK GAAP, deferred taxation is provided at the rates at which the taxation is expected to become payable. No

provision is made for amounts which are not expected to become payable in the foreseeable future.

Under US GAAP, deferred taxation is provided on all temporary differences under the liability method at tax rates

applicable to the relevant future year.

Capitalisation of interest costs

Under UK GAAP, interest on borrowing used to finance the construction of an asset is not required to be included in the

http://www.vodafone.com/download/investor/reports/annual98/finance/uspolicies.html (2 of 3)29/03/2007 23:12:13