Vodafone 1998 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1998 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Report and Accounts - Financial Review

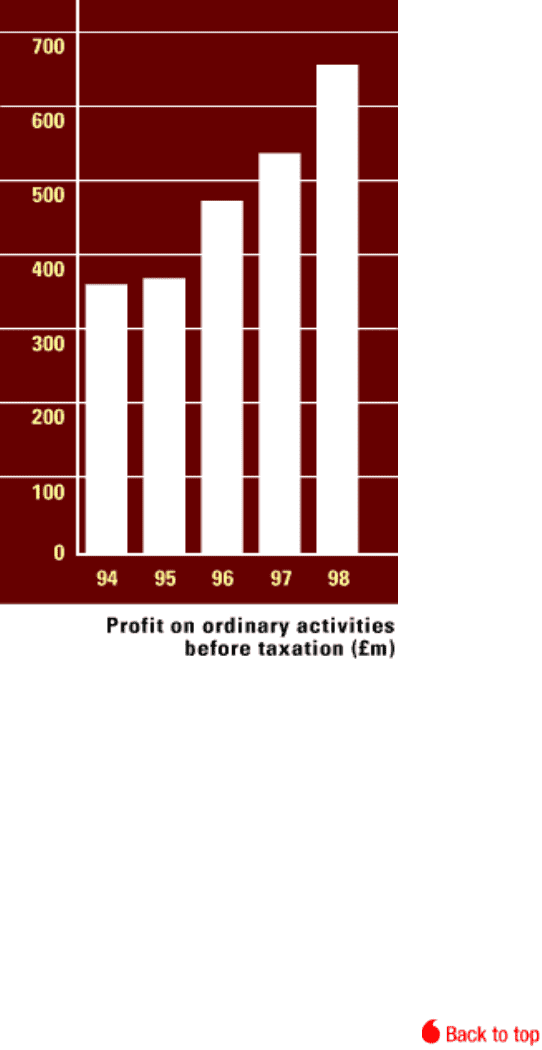

primarily arose as a result of the strength of sterling against the Greek

drachma. The largest contribution to the advance in total operating profit was

achieved in Continental Europe, which improved by £106.4m as Panafon

continued to trade strongly and its results were fully consolidated for a full

twelve months. Net losses in the Pacific Rim increased by £20.2m to £59.2m,

primarily due to the Australian businesses. However, the network company

went through break-even in January 1998 and the Australian businesses as a

whole should achieve overall profitability in 1998/99. Profits increased in the

Rest of the World to £43.7m as the South African businesses continued to

perform strongly.

Profit on disposal of fixed assets

The profit on disposal of fixed asset investments arose from a part disposal of

the Group's interest in Globalstar, the disposal of the Group's 35% stake in

Pacific Link and the disposal of the Group's 16% interest in the UK service

provider, Cellphones Direct.

Interest

The Group's net interest cost increased by £35.4m as borrowings increased

by £436.4m to finance international acquisitions.

Taxation

The effective tax rate fell by 0.6% to 31.3% as a result of the beneficial impact

of the reduction in the UK corporation tax rate from 33% to 31% offset by

higher tax overseas, particularly in Greece where brought forward losses

have now been fully utilised and the corporation tax rate increased by 5% to

40%. Excluding the effect of disposals, the effective tax rate fell from 33.5% to

32.5%.

Minority interests

The increase in the minority interests in profit on ordinary activities after

taxation is primarily due to the impact of the inclusion of the 55% owned

Greek subsidiary, Panafon, for a full twelve months.

http://www.vodafone.com/download/investor/reports/annual98/financialreview/profitandloss.html (2 of 2)29/03/2007 23:08:54