Under Armour 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

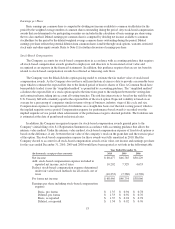

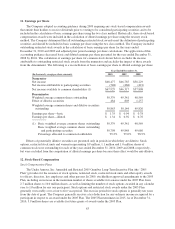

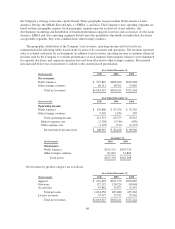

11. Earnings per Share

The Company adopted accounting guidance during 2009 requiring any stock-based compensation awards

that entitle their holders to receive dividends prior to vesting to be considered participating securities and to be

included in the calculation of basic earnings per share using the two class method. Historically, these stock-based

compensation awards were included in the calculation of diluted earnings per share using the treasury stock

method. The Company determined that all outstanding restricted stock awards meet the definition of participating

securities and should be included in basic earnings per share using the two class method. The Company included

outstanding restricted stock awards in the calculation of basic earnings per share for the years ended

December 31, 2010 and 2009 and adjusted prior period earnings per share calculations. The application of this

accounting guidance decreased basic and diluted earnings per share presented for the year ended December 31,

2008 by $0.01. The calculation of earnings per share for common stock shown below excludes the income

attributable to outstanding restricted stock awards from the numerator and excludes the impact of these awards

from the denominator. The following is a reconciliation of basic earnings per share to diluted earnings per share:

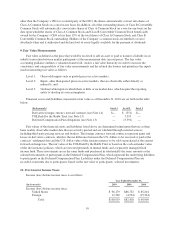

Year Ended December 31,

(In thousands, except per share amounts) 2010 2009 2008

Numerator

Net income $68,477 $46,785 $38,229

Net income attributable to participating securities (548) (468) (421)

Net income available to common shareholders (1) $67,929 $46,317 $37,808

Denominator

Weighted average common shares outstanding 50,379 49,341 48,569

Effect of dilutive securities 484 803 1,257

Weighted average common shares and dilutive securities

outstanding 50,863 50,144 49,826

Earnings per share—basic $ 1.35 $ 0.94 $ 0.78

Earnings per share—diluted $ 1.34 $ 0.92 $ 0.76

(1) Basic weighted average common shares outstanding 50,379 49,341 48,569

Basic weighted average common shares outstanding

and participating securities 50,798 49,848 49,086

Percentage allocated to common stockholders 99.2% 99.0% 98.9%

Effects of potentially dilutive securities are presented only in periods in which they are dilutive. Stock

options, restricted stock units and warrants representing 0.9 million, 1.1 million and 1.0 million shares of

common stock were outstanding for each of the years ended December 31, 2010, 2009 and 2008, respectively,

but were excluded from the computation of diluted earnings per share because their effect would be anti-dilutive.

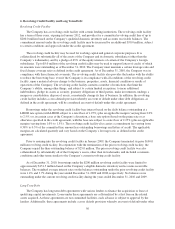

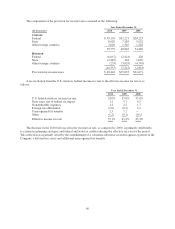

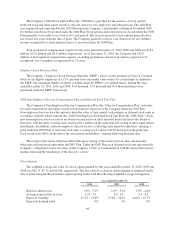

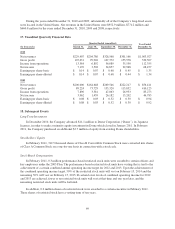

12. Stock-Based Compensation

Stock Compensation Plans

The Under Armour, Inc. Amended and Restated 2005 Omnibus Long-Term Incentive Plan (the “2005

Plan”) provides for the issuance of stock options, restricted stock, restricted stock units and other equity awards

to officers, directors, key employees and other persons. In 2009, stockholders approved amendments to the 2005

Plan, including an increase in the maximum number of shares available for issuance under the 2005 Plan from

2.7 million shares to 10.0 million shares, as well as limiting the number of stock options awarded in any calendar

year to 1.0 million for any one participant. Stock options and restricted stock awards under the 2005 Plan

generally vest ratably over a four to five year period. The exercise period for stock options is generally ten years

from the date of grant. The Company generally receives a tax deduction for any ordinary income recognized by a

participant in respect to an award under the 2005 Plan. The 2005 Plan terminates in 2015. As of December 31,

2010, 5.9 million shares are available for future grants of awards under the 2005 Plan.

63