Under Armour 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

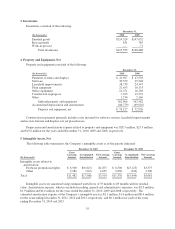

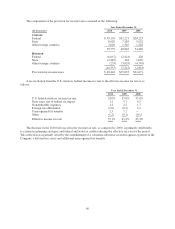

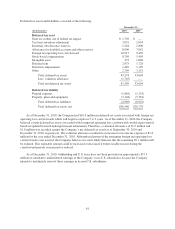

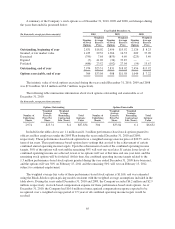

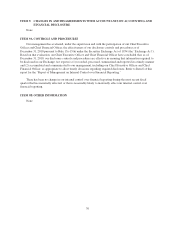

Deferred tax assets and liabilities consisted of the following:

December 31,

(In thousands) 2010 2009

Deferred tax asset

State tax credits, net of federal tax impact $ 1,750 $ —

Tax basis inventory adjustment 3,052 1,874

Inventory obsolescence reserves 2,264 2,800

Allowance for doubtful accounts and other reserves 8,996 7,042

Foreign net operating loss carryforward 10,917 9,476

Stock-based compensation 8,790 5,450

Intangible asset 372 1,068

Deferred rent 2,975 1,728

Deferred compensation 1,449 1,105

Other 2,709 3,151

Total deferred tax assets 43,274 33,694

Less: valuation allowance (1,765) —

Total net deferred tax assets 41,509 33,694

Deferred tax liability

Prepaid expenses (1,865) (1,133)

Property, plant and equipment (3,104) (5,783)

Total deferred tax liabilities (4,969) (6,916)

Total deferred tax assets, net $36,540 $26,778

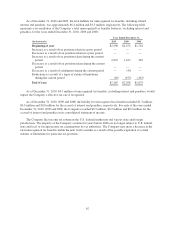

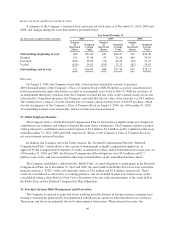

As of December 31, 2010, the Company had $10.9 million in deferred tax assets associated with foreign net

operating loss carryforwards which will begin to expire in 5 to 9 years. As of December 31, 2010, the Company

believed certain deferred tax assets associated with foreign net operating loss carryforwards would expire unused

based on updated forward-looking financial information. Therefore, a valuation allowance of $1.5 million and

$1.8 million was recorded against the Company’s net deferred tax assets as of September 30, 2010 and

December 31, 2010, respectively. The valuation allowance resulted in an increase to income tax expense of $1.8

million for the year ended December 31, 2010. Although realization of the remaining foreign net operating loss

carryforwards is not assured, the Company believes it is more likely than not that the remaining $9.1 million will

be realized. This realizable amount could be increased or decreased if future taxable income during the

carryforward periods is increased or reduced.

As of December 31, 2010, withholding and U.S. taxes have not been provided on approximately $37.3

million of cumulative undistributed earnings of the Company’s non-U.S. subsidiaries because the Company

intends to indefinitely reinvest these earnings in its non-U.S. subsidiaries.

61