Under Armour 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We monitor the financial health and stability of our lenders under the revolving credit and long term debt

facilities, however continuing significant instability in the credit markets could negatively impact lenders and

their ability to perform under their facilities.

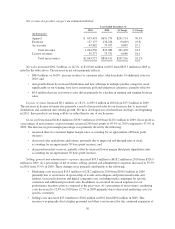

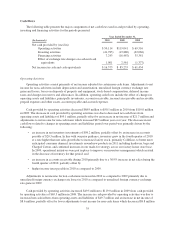

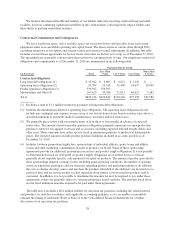

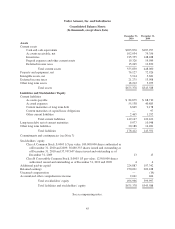

Contractual Commitments and Contingencies

We lease warehouse space, office facilities, space for our factory house and specialty stores and certain

equipment under non-cancelable operating and capital leases. The leases expire at various dates through 2021,

excluding extensions at our option, and contain various provisions for rental adjustments. In addition, this table

includes executed lease agreements for factory house stores that we did not yet occupy as of December 31, 2010.

The operating leases generally contain renewal provisions for varying periods of time. Our significant contractual

obligations and commitments as of December 31, 2010 are summarized in the following table:

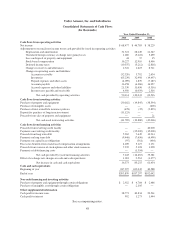

Payments Due by Period

(in thousands) Total

Less Than

1 Year 1 to 3 Years 3 to 5 Years

More Than

5 Years

Contractual obligations

Long term debt obligations (1) $ 15,942 $ 6,865 $ 6,821 $ 2,256 $ —

Operating lease obligations (2) 95,704 19,528 31,400 24,677 20,099

Product purchase obligations (3) 356,943 356,943 — — —

Sponsorships and other (4) 167,629 43,506 72,015 48,625 3,483

Total $636,218 $426,842 $110,236 $75,558 $23,582

(1) Excludes a total of $1.1 million in interest payments on long term debt obligations.

(2) Includes the minimum payments for operating lease obligations. The operating lease obligations do not

include any contingent rent expense we may incur at our factory house stores based on future sales above a

specified minimum or payments made for maintenance, insurance and real estate taxes.

(3) We generally place orders with our manufacturers at least three to four months in advance of expected

future sales. The amounts listed for product purchase obligations primarily represent our open production

purchase orders for our apparel, footwear and accessories, including expected inbound freight, duties and

other costs. These open purchase orders specify fixed or minimum quantities of products at determinable

prices. The reported amounts exclude product purchase liabilities included in accounts payable as of

December 31, 2010.

(4) Includes footwear promotional rights fees, sponsorships of individual athletes, sports teams and athletic

events and other marketing commitments in order to promote our brand. Some of these sponsorship

agreements provide for additional performance incentives and product supply obligations. It is not possible

to determine how much we will spend on product supply obligations on an annual basis as contracts

generally do not stipulate specific cash amounts to be spent on products. The amount of product provided to

these sponsorships depends on many factors including general playing conditions, the number of sporting

events in which they participate and our decisions regarding product and marketing initiatives. In addition,

the costs to design, develop, source and purchase the products furnished to the endorsers are incurred over a

period of time and are not necessarily tracked separately from similar costs incurred for products sold to

customers. In addition, it is not possible to determine the amounts we may be required to pay under these

agreements as they are primarily subject to certain performance based variables. The amounts listed above

are the fixed minimum amounts required to be paid under these agreements.

The table above excludes a $6.4 million liability for uncertain tax positions, including the related interest

and penalties, recorded in accordance with applicable accounting guidance, as we are unable to reasonably

estimate the timing of settlement. Refer to Note 10 to the Consolidated Financial Statements for a further

discussion of our uncertain tax positions.

38