Ulta 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

on October 30, 2007. As a result, the Company has elected to generally use the shortcut approach to

determine the expected life in accordance with the SEC Staff Accounting Bulletin on share-based payments.

Any dividend the Company might declare in the future would be subject to the applicable provisions of its

credit agreement, which currently limits the Company’s ability to pay cash dividends.

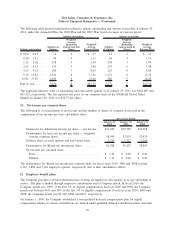

The Company granted 1,521 stock options during fiscal 2010. The compensation cost that has been charged

against income was $9,918, $5,949, and $3,877 for fiscal 2010, 2009, and 2008, respectively. The total

income tax benefit recognized in the income statement for the share-based compensation arrangements was

$3,300, $1,464 and $984 for fiscal 2010, 2009 and 2008, respectively. The weighted-average grant date fair

value of options granted in fiscal 2010, 2009 and 2008 was $13.58, $6.64 and $5.46, respectively. At

January 29, 2011, there was approximately $21,784 of unrecognized compensation expense related to unvested

stock options. The unrecognized compensation expense is expected to be recognized over a weighted-average

period of approximately two years.

The total intrinsic value of options exercised was $42,118, $4,783 and $8,267 in fiscal 2010, 2009 and 2008,

respectively.

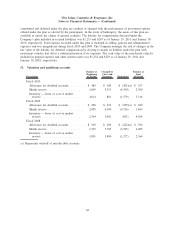

Restricted stock awards

During fiscal 2010, the Company granted 119 restricted common shares with a fair value of $23.32 per share

to its newly appointed President and Chief Executive Officer. The restricted shares cannot be sold or

otherwise transferred during the vesting period. The award cliff vests on December 29, 2011. The award is

being expensed on a straight-line basis over the 20 month vesting period. The compensation expense recorded

in fiscal 2010 was $1,237. At January 29, 2011, unrecognized compensation cost related to the award was

$1,543.

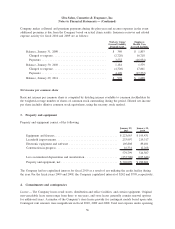

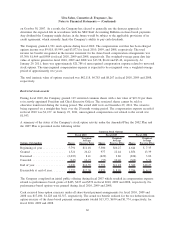

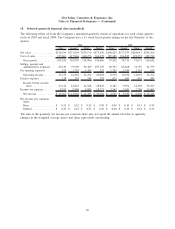

A summary of the status of the Company’s stock option activity under the Amended Plan, the 2002 Plan and

the 2007 Plan is presented in the following tables:

Options Outstanding Shares

Weighted-

Average

Exercise Price Shares

Weighted-

Average

Exercise Price Shares

Weighted-

Average

Exercise Price

Fiscal 2010 Fiscal 2009 Fiscal 2008

Common Stock Options

Beginning of year .............. 5,791 $11.18 5,300 $10.27 4,644 $ 7.35

Granted ..................... 1,521 26.12 977 12.44 1,856 13.39

Exercised .................... (2,033) 8.41 (429) 2.86 (834) 3.02

Canceled .................... (243) 16.73 (57) 10.46 (366) 5.51

End of year .................. 5,036 $16.55 5,791 $11.18 5,300 $10.27

Exercisable at end of year ........ 2,272 $12.38 2,971 $ 8.99 2,296 $ 6.17

The Company completed an initial public offering during fiscal 2007 which resulted in compensation expense

related to performance based grants of $425, $637 and $576 in fiscal 2010, 2009 and 2008, respectively. No

performance-based options were granted during fiscal 2010, 2009 and 2008.

Cash received from option exercises under all share-based payment arrangements for fiscal 2010, 2009 and

2008 was $17,100, $1,228 and $2,517, respectively. The actual tax benefit realized for the tax deductions from

option exercise of the share-based payment arrangements totaled $13,373, $630 and $1,774, respectively, for

fiscal 2010, 2009 and 2008.

62

Ulta Salon, Cosmetics & Fragrance, Inc.

Notes to Financial Statements — (Continued)