Ulta 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

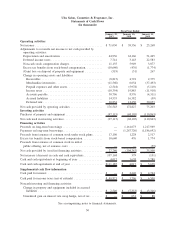

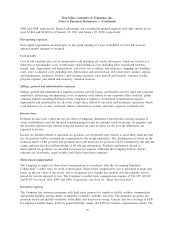

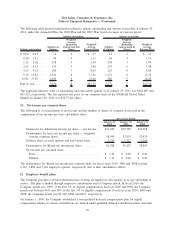

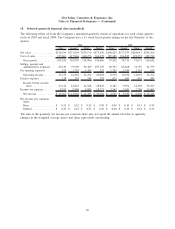

Company makes collateral and premium payments during the plan year and accrues expenses in the event

additional premium is due from the Company based on actual claim results. Insurance reserves and related

expense activity for fiscal 2010 and 2009 are as follows:

Workers Comp/

General Liability

Prepaid Asset

Employee

Health Care

Accrued Liability

Balance, January 31, 2009 ............................. $ 369 $ 1,803

Charged to expense................................. (2,720) 16,710

Payments ........................................ 3,532 (16,934)

Balance, January 30, 2010 ............................. 1,181 1,579

Charged to expense................................. (4,320) 17,601

Payments ........................................ 4,109 (17,572)

Balance, January 29, 2011 ............................. $ 970 $ 1,608

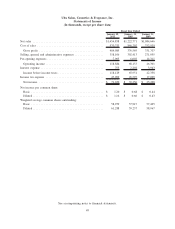

Net income per common share

Basic net income per common share is computed by dividing income available to common stockholders by

the weighted-average number of shares of common stock outstanding during the period. Diluted net income

per share includes dilutive common stock equivalents, using the treasury stock method.

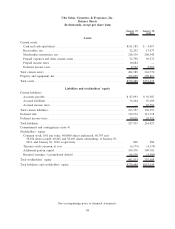

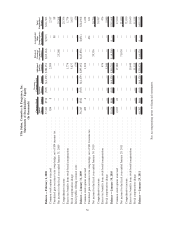

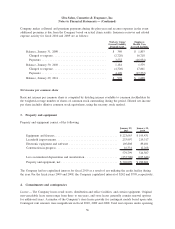

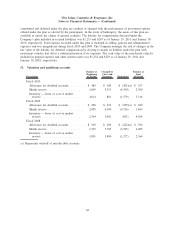

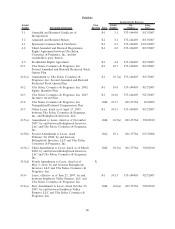

3. Property and equipment

Property and equipment consist of the following:

January 29,

2011

January 30,

2010

Equipment and fixtures ....................................... $223,663 $ 195,431

Leasehold improvements...................................... 233,997 219,317

Electronic equipment and software . . . ........................... 105,808 89,491

Construction-in-progress ...................................... 16,331 12,268

579,799 516,507

Less accumulated depreciation and amortization .................... (253,700) (225,646)

Property and equipment, net ................................... $326,099 $ 290,861

The Company had no capitalized interest for fiscal 2010 as a result of not utilizing the credit facility during

the year. For the fiscal years 2009 and 2008, the Company capitalized interest of $242 and $799, respectively.

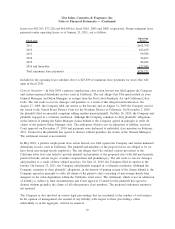

4. Commitments and contingencies

Leases — The Company leases retail stores, distribution and office facilities, and certain equipment. Original

non-cancelable lease terms range from three to ten years, and store leases generally contain renewal options

for additional years. A number of the Company’s store leases provide for contingent rentals based upon sales.

Contingent rent amounts were insignificant in fiscal 2010, 2009 and 2008. Total rent expense under operating

56

Ulta Salon, Cosmetics & Fragrance, Inc.

Notes to Financial Statements — (Continued)