Ulta 2010 Annual Report Download - page 46

Download and view the complete annual report

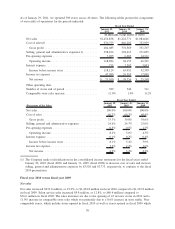

Please find page 46 of the 2010 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.evaluates these estimates on an on-going basis. Actual results may differ from these estimates. A discussion of

our more significant estimates follows. Management has discussed the development, selection, and disclosure

of these estimates and assumptions with the audit committee of the board of directors.

Inventory valuation

Merchandise inventories are carried at the lower of average cost or market value. Cost is determined using the

weighted-average cost method and includes costs incurred to purchase and distribute goods as well as related

vendor allowances including co-op advertising, markdowns, and volume discounts. We record valuation

adjustments to our inventories if the cost of a specific product on hand exceeds the amount we expect to

realize from the ultimate sale or disposal of the inventory. These estimates are based on management’s

judgment regarding future demand, age of inventory, and analysis of historical experience. If actual demand or

market conditions are different than those projected by management, future merchandise margin rates may be

unfavorably or favorably affected by adjustments to these estimates.

Inventories are adjusted for the results of periodic physical inventory counts at each of our locations. We

record a shrink reserve representing management’s estimate of inventory losses by location that have occurred

since the date of the last physical count. This estimate is based on management’s analysis of historical results

and operating trends. Adjustments to earnings resulting from revisions to management’s estimates of the lower

of cost or market and shrink reserves have been insignificant during fiscal 2010, 2009 and 2008.

Impairment of long-lived tangible assets

We review long-lived tangible assets whenever events or circumstances indicate these assets might not be

recoverable based on undiscounted future cash flows. Assets are reviewed at the lowest level for which cash

flows can be identified, which is the store level. Significant estimates are used in determining future operating

results of each store over its remaining lease term. If such assets are considered to be impaired, the

impairment to be recognized is measured by the amount by which the carrying amount of the assets exceeds

the fair value of the assets. We have not recorded an impairment charge in any of the periods presented in the

accompanying financial statements.

Share-based compensation

We account for share-based compensation in accordance with the Accounting Standards Codification

TM

(ASC) rules

for stock compensation. Share-based compensation cost is measured at grant date, based on the fair value of the

award, and is recognized on a straight-line method over the requisite service period for awards expected to vest.

We estimate the grant date fair value of stock options using a Black-Scholes valuation model. The expected

volatility is based on volatilities of our stock and a peer group of publicly-traded companies. The risk free

interest rate is based on the United States Treasury yield curve in effect on the date of grant for the respective

expected life of the option. The expected life represents the time the options granted are expected to be

outstanding. We have limited historical data related to exercise behavior since our initial public offering on

October 30, 2007. As a result, we have elected to use the shortcut approach to determine the expected life in

accordance with the SEC Staff Accounting Bulletin on share-based payments.

See notes to financial statements, “Summary of significant accounting policies — Share-based compensation,”

for disclosure related to the Company’s stock compensation expense and related valuation model assumptions.

See Note 10 to our financial statements, “Share-based awards,” for disclosure related to our stock

compensation expense and related valuation model assumptions.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

Market risk represents the risk of loss that may impact our financial position due to adverse changes in

financial market prices and rates. Our market risk exposure is primarily the result of fluctuations in interest

rates. We do not hold or issue financial instruments for trading purposes.

Interest rate sensitivity

We are exposed to interest rate risks primarily through borrowing under our credit facility. Interest on our

borrowings is based upon variable rates. We did not utilize the credit facility during fiscal 2010.

42