Ulta 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• stock transactions by our principal stockholders;

• recruitment or departure of key personnel; and

• the level and quality of securities research analyst coverage for our common stock.

In addition, public announcements by our competitors, other retailers and vendors concerning, among other

things, their performance, strategy, or accounting practices could cause the market price of our common stock

to decline regardless of our actual operating performance.

Our comparable store sales and quarterly financial performance may fluctuate for a variety of reasons,

which could result in a decline in the price of our common stock.

Our comparable store sales and quarterly results of operations have fluctuated in the past, and we expect them

to continue to fluctuate in the future. A variety of other factors affect our comparable store sales and quarterly

financial performance, including:

• general U.S. economic conditions and, in particular, the retail sales environment;

• changes in our merchandising strategy or mix;

• performance of our new and remodeled stores;

• the effectiveness of our inventory management;

• timing and concentration of new store openings, including additional human resource requirements and

related pre-opening and other start-up costs;

• cannibalization of existing store sales by new store openings;

• levels of pre-opening expenses associated with new stores;

• timing and effectiveness of our marketing activities, such as catalogs and newspaper inserts;

• seasonal fluctuations due to weather conditions; and

• actions by our existing or new competitors.

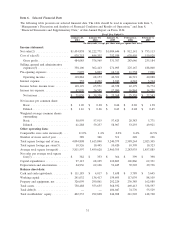

Accordingly, our results for any one fiscal quarter are not necessarily indicative of the results to be expected

for any other quarter, and comparable store sales for any particular future period may decrease. In that event,

the price of our common stock would likely decline. For more information on our quarterly results of

operations, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of

Operations.”

Our current principal stockholder has significant influence over us and they could delay, deter, or prevent a

change of control or other business combination or otherwise cause us to take action with which you might

not agree.

Our principal stockholder owns or controls, in the aggregate, approximately 18% of our outstanding common

stock. As a result, this stockholder will be able to exercise significant influence over all matters requiring

stockholder approval, including the election of directors, amendment of our certificate of incorporation and

approval of significant corporate transactions and will have significant influence over our management and

policies. Such concentration of voting power could have the effect of delaying or deterring a change of control

or other business combination that might otherwise be beneficial to our stockholders. In addition, the

significant concentration of share ownership may adversely affect the trading price of our common stock

because investors often perceive disadvantages in owning shares in companies with a stockholder holding such

significant influence.

24