Ulta 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We did not utilize the new credit facility during fiscal 2010 and had no borrowings outstanding under the new

credit facility as of January 29, 2011.

Seasonality

Our business is subject to seasonal fluctuation. Significant portions of our net sales and profits are realized

during the fourth quarter of the fiscal year due to the holiday selling season. To a lesser extent, our business is

also affected by Mothers’ Day as well as the “Back to School” season and Valentines’ Day. Any decrease in

sales during these higher sales volume periods could have an adverse effect on our business, financial

condition, or operating results for the entire fiscal year. Our quarterly results of operations have varied in the

past and are likely to do so again in the future. As such, we believe that period-to-period comparisons of our

results of operations should not be relied upon as an indication of our future performance.

Impact of inflation and changing prices

Although we do not believe that inflation has had a material impact on our financial position or results of

operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain

current levels of gross margin and selling, general and administrative expenses as a percentage of net sales if

the selling prices of our products do not increase with these increased costs. In addition, inflation could

materially increase the interest rates on our debt.

Off-balance sheet arrangements

Our off-balance sheet arrangements consist of operating lease obligations and letters of credit. We do not have

any non-cancelable purchase commitments as of January 29, 2011. Our letters of credit outstanding under our

revolving credit facility expired in September 2009; the balance was $0.3 million as of January 31, 2009.

Contractual obligations

We lease retail stores, warehouses, corporate offices and certain equipment under operating leases with various

expiration dates through fiscal 2024. Our store leases generally have initial lease terms of 10 years and include renewal

options under substantially the same terms and conditions as the original leases. In addition to future minimum lease

payments, most of our lease agreements include escalating rent provisions which we recognize straight-line over the

term of the lease, including any lease renewal periods deemed to be probable. For certain locations, we receive cash

tenant allowances and we report these amounts as deferred rent, which is amortized on a straight-line basis as a

reduction of rent expense over the term of the lease, including any lease renewal periods deemed to be probable.

While a number of our store leases include contingent rentals, contingent rent amounts are insignificant.

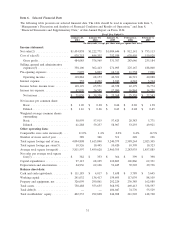

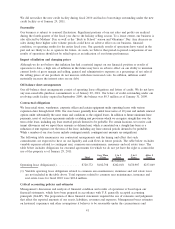

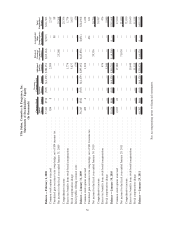

The following table summarizes our contractual arrangements and the timing and effect that such

commitments are expected to have on our liquidity and cash flows in future periods. The table below excludes

variable expenses related to contingent rent, common area maintenance, insurance and real estate taxes. The

table below includes obligations for executed agreements for which we do not yet have the right to control the

use of the property as of January 29, 2011:

Total

Less Than

1 Year

1to3

Years

3to5

Years

After 5

Years

(In thousands)

Operating lease obligations(1) .............. $720,772 $102,798 $202,018 $178,907 $237,049

(1) Variable operating lease obligations related to common area maintenance, insurance and real estate taxes

are not included in the table above. Total expenses related to common area maintenance, insurance and

real estate taxes for fiscal 2010 were $22.4 million.

Critical accounting policies and estimates

Management’s discussion and analysis of financial condition and results of operations is based upon our

financial statements, which have been prepared in accordance with U.S. generally accepted accounting

principals (GAAP). The preparation of these financial statements required the use of estimates and judgments

that affect the reported amounts of our assets, liabilities, revenues and expenses. Management bases estimates

on historical experience and other assumptions it believes to be reasonable under the circumstances and

41