Ulta 2010 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2010 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net sales(2)

Cost of sales(3)

Gross profit

Selling, general & administrative expenses(3)

Pre-opening expenses

Operating income

Interest expense

Income before income taxes

Income tax expense

Net income

Net income per common share:

Basic

Diluted

Comparable store sales increase(4)

Number of stores end of year

Net sales per average total square foot(5)

Capital expenditures

Depreciation and amortization

Cash and cash equivalents

Working capital

Property and equipment, net

Total assets

Total debt

Total stockholders' equity

FISCAL YEAR ENDED (1)

January 29, 2011

$

1,454,838

970,753

484,085

358,106

7,095

118,884

755

118,129

47,099

$ 71,030

$ 1.20

$ 1.16

11.0%

389

$

382

97,115

64,936

$

111,185

241,032

326,099

730,488

–

402,533

January 30, 2010

$

1,222,771

846,202

376,569

302,413

6,003

68,153

2,202

65,951

26,595

$ 39,356

$

0.68

$

0.66

1.4%

346

$

353

68,105

62,166

$

4,017

136,417

290,861

553,635

–

292,608

January 31, 2009

$ 1,084,646

752,939

331,707

271,095

14,311

46,301

3,943

42,358

17,090

$

25,268

$ 0.44

$ 0.43

0.2%

311

$ 366

110,863

51,445

$

3,638

159,695

292,224

568,932

106,047

244,968

February 2, 2008

$

912,141

628,495

283,646

225,167

11,758

46,721

4,542

42,179

16,844

$ 25,335

$ 0.69

$ 0.48

6.4%

249

$ 399

101,866

39,503

$

3,789

117,039

236,389

469,413

74,770

211,503

February 3, 2007

$

755,113

519,929

235,184

188,000

7,096

40,088

3,314

36,774

14,231

$ 22,543

$ 1.38

$ 0.45

14.5%

196

$ 398

62,331

29,736

$

3,645

88,105

162,080

338,597

55,529

148,760

(1) Our fiscal year-end is the Saturday closest to January 31 based on a 52/53-week year. Each fiscal year consists of four 13-week quarters, with an extra week added onto the fourth quarter

every five or six years.

(2) Fiscal 2006 was a 53-week operating year and the 53rd week represented approximately $16.4 million in net sales.

(3) The Company made reclassifications in the consolidated income statements for the fiscal years ended January 30, 2010 (fiscal 2009) and January 31, 2009 (fiscal 2008) to decrease cost

of sales and increase selling, general and administrative expenses by $3,520 and $3,773, respectively, to conform to the fiscal 2010 presentation. Amounts were insignificant for fiscal 2007

and 2006.

(4) Comparable store sales increase reflects sales for stores beginning on the first day of the 14th month of operation. Remodeled stores are included in comparable store sales unless the

store was closed for a portion of the current or comparable prior year.

(5) Net sales per average total square foot was calculated by dividing net sales for the year by the average square footage for those stores open during each year. Fiscal 2006 net sales per

average total square foot were adjusted to exclude the net sales effect of the 53rd week.

INCOME STATEMENT:

(IN THOUSANDS, EXCEPT PER SHARE AND PER SQUARE FOOT DATA)

OTHER OPERATING DATA:

BALANCE SHEET DATA:

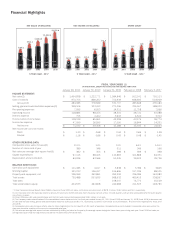

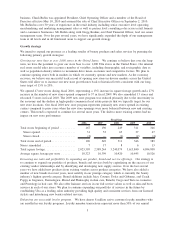

2006 2007 2008 2009 2010

$1,454.8

$1,222.8

$1,084.6

$912.1

$755.1

30% 21% 13% 19%19%

NET SALES (IN MILLIONS)

5 YEAR CAGR - 20%*

2006 2007 2008 2009 2010

NET INCOME (IN MILLIONS)

5 YEAR CAGR - 35%*

2006 2007 2008 2009 2010

STORE COUNT

5 YEAR CAGR - 18%*

* 5-Year Compound Annual Growth Rate (CAGR) is based on fiscal 2005 net sales, net income and store count of $579.1 million, $16.0 million and 167, respectively.

$71.0

$39.4

$25.3$25.3

$22.5

41% 56% 80%0%

389

346

311

249

196

17% 27% 11% 12%25%

12%

Net sales(2)

Cost of sales(3)

Gross profit

Selling, general & administrative expenses(3)

Pre-opening expenses

Operating income

Interest expense

Income before income taxes

Income tax expense

Net income

Net income per common share:

Basic

Diluted

Comparable store sales increase(4)

Number of stores end of year

Net sales per average total square foot(5)

Capital expenditures

Depreciation and amortization

Cash and cash equivalents

Working capital

Property and equipment, net

Total assets

Total debt

Total stockholders' equity

FISCAL YEAR ENDED (1)

January 29, 2011

$ 1,454,838

970,753

484,085

358,106

7,095

118,884

755

118,129

47,099

$ 71,030

$ 1.20

$ 1.16

11.0%

389

$ 382

97,115

64,936

$ 111,185

241,032

326,099

730,488

–

402,533

January 30, 2010

$ 1,222,771

846,202

376,569

302,413

6,003

68,153

2,202

65,951

26,595

$ 39,356

$ 0.68

$ 0.66

1.4%

346

$ 353

68,105

62,166

$ 4,017

136,417

290,861

553,635

–

292,608

January 31, 2009

$ 1,084,646

752,939

331,707

271,095

14,311

46,301

3,943

42,358

17,090

$ 25,268

$ 0.44

$ 0.43

0.2%

311

$ 366

110,863

51,445

$ 3,638

159,695

292,224

568,932

106,047

244,968

February 2, 2008

$ 912,141

628,495

283,646

225,167

11,758

46,721

4,542

42,179

16,844

$ 25,335

$ 0.69

$ 0.48

6.4%

249

$ 399

101,866

39,503

$ 3,789

117,039

236,389

469,413

74,770

211,503

February 3, 2007

$ 755,113

519,929

235,184

188,000

7,096

40,088

3,314

36,774

14,231

$ 22,543

$ 1.38

$ 0.45

14.5%

196

$ 398

62,331

29,736

$ 3,645

88,105

162,080

338,597

55,529

148,760

(1) Our fiscal year-end is the Saturday closest to January 31 based on a 52/53-week year. Each fiscal year consists of four 13-week quarters, with an extra week added onto the fourth quarter

every five or six years.

(2) Fiscal 2006 was a 53-week operating year and the 53rd week represented approximately $16.4 million in net sales.

(3) The Company made reclassifications in the consolidated income statements for the fiscal years ended January 30, 2010 (fiscal 2009) and January 31, 2009 (fiscal 2008) to decrease cost

of sales and increase selling, general and administrative expenses by $3,520 and $3,773, respectively, to conform to the fiscal 2010 presentation. Amounts were insignificant for fiscal 2007

and 2006.

(4) Comparable store sales increase reflects sales for stores beginning on the first day of the 14th month of operation. Remodeled stores are included in comparable store sales unless the

store was closed for a portion of the current or comparable prior year.

(5) Net sales per average total square foot was calculated by dividing net sales for the year by the average square footage for those stores open during each year. Fiscal 2006 net sales per

average total square foot were adjusted to exclude the net sales effect of the 53rd week.

INCOME STATEMENT:

(IN THOUSANDS, EXCEPT PER SHARE AND PER SQUARE FOOT DATA)

OTHER OPERATING DATA:

BALANCE SHEET DATA:

* 5-Year Compound Annual Growth Rate (CAGR) is based on fiscal 2005 net sales, net income and store count of $579.1 million, $16.0 million and 167, respectively.

2006 2007 2008 2009 2010

$1,454.8

$1,222.8

$1,084.6

$912.1

$755.1

30% 21% 13% 19%19%

NET SALES (IN MILLIONS)

5 YEAR CAGR - 20%*

2006 2007 2008 2009 2010

NET INCOME (IN MILLIONS)

5 YEAR CAGR - 35%*

2006 2007 2008 2009 2010

STORE COUNT

5 YEAR CAGR - 18%*

$71.0

$39.4

$25.3$25.3

$22.5

41% 56% 80%

389

346

311

249

196

17% 27% 11% 12%25%

12% 0%

Financial Highlights