Ulta 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

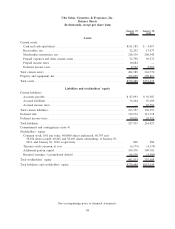

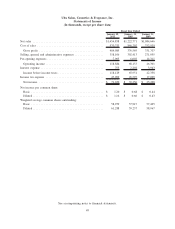

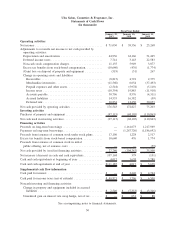

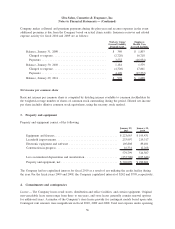

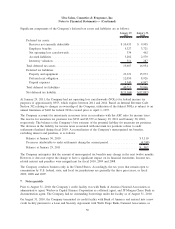

Ulta Salon, Cosmetics & Fragrance, Inc.

Statements of Cash Flows

(In thousands)

January 29,

2011

January 30,

2010

January 31,

2009

Fiscal Year Ended

Operating activities

Net income .......................................... $ 71,030 $ 39,356 $ 25,268

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization .......................... 64,936 62,166 51,445

Deferred income taxes ................................ 7,741 3,143 22,583

Non-cash stock compensation charges..................... 11,155 5,949 3,877

Excess tax benefits from stock-based compensation........... (10,640) (476) (1,774)

(Gain) loss on disposal of property and equipment ........... (519) (51) 267

Change in operating assets and liabilities:

Receivables ...................................... (8,815) 4,791 2,375

Merchandise inventories ............................. (11,568) 6,654 (37,493)

Prepaid expenses and other assets ...................... (2,518) (5,978) (5,110)

Income taxes ..................................... (10,354) 19,885 (11,918)

Accounts payable .................................. 30,706 8,576 (4,311)

Accrued liabilities ................................. 14,535 16,382 (59)

Deferred rent ..................................... 20,854 12,430 30,053

Net cash provided by operating activities .................... 176,543 172,827 75,203

Investing activities

Purchases of property and equipment ....................... (97,115) (68,105) (110,863)

Net cash used in investing activities ........................ (97,115) (68,105) (110,863)

Financing activities

Proceeds on long-term borrowings ......................... — 1,161,673 1,217,969

Payments on long-term borrowings......................... — (1,267,720) (1,186,692)

Proceeds from issuance of common stock under stock plans ...... 17,100 1,228 2,517

Excess tax benefits from stock-based compensation ............ 10,640 476 1,774

Proceeds from issuance of common stock in initial

public offering, net of issuance costs ..................... — — (59)

Net cash provided by (used in) financing activities ............. 27,740 (104,343) 35,509

Net increase (decrease) in cash and cash equivalents ............ 107,168 379 (151)

Cash and cash equivalents at beginning of year ............... 4,017 3,638 3,789

Cash and cash equivalents at end of year .................... $111,185 $ 4,017 $ 3,638

Supplemental cash flow information

Cash paid for interest................................... $ — $ 2,440 $ 4,764

Cash paid for income taxes (net of refunds) .................. $ 49,871 $ 3,706 $ 6,509

Noncash investing and financing activities:

Change in property and equipment included in accrued

liabilities ........................................ $ 2,540 $ (7,353) $ (3,316)

Unrealized gain on interest rate swap hedge, net of tax ........ $ — $ 631 $ 88

See accompanying notes to financial statements.

50